Money transfer services have revolutionized the way transactions are made in our era. The development of e-wallets and online payment platforms has made it easier for people to send and receive money from all over the world. Volet, Wise, PerfectMoney, Payeer, Skrill are some of the most popular money transfer services used by ordinary people today. In this article, we will compare these services and highlight their pros and cons.

What is Volet?

Volet is an electronic payment platform that allows you to make online payments, transfer money and buy/sell cryptocurrencies. It was founded in 2014 and is based in Belize. Volet allows users to deposit and withdraw funds using bank transfers, credit/debit cards, and cryptocurrencies. It supports many currencies and has low transaction fees. Volet is popular among online merchants and freelancers.

Pros of Volet

- Low transaction fees

- Supports multiple currencies

- Allows users to buy/sell cryptocurrencies

- Popular with online marketers and freelancers

Cons

- Limited customer support

- Not as widespread as other payment systems

- Some users find the verification process tedious

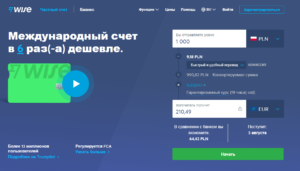

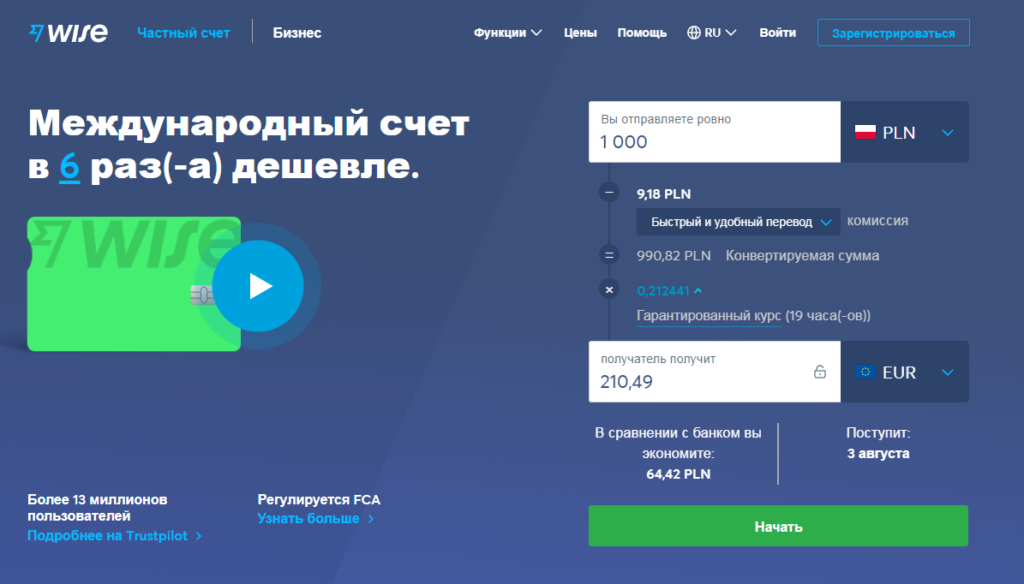

What is Wise?

Wise, formerly known as TransferWise, is a peer-to-peer money transfer service founded in 2010. It allows you to send and receive money around the world with low fees and an exchange rate close to the market average. Wise has a simple and user-friendly interface that allows users to easily transfer money. It supports many currencies and has over 10 million customers worldwide.

Pros of Wise

- Low commissions and exchange rates close to the average market rate

- Simple and user friendly interface

- Supports multiple currencies

- Over 10 million customers worldwide

Cons

- Limited payment options

- Does not support cryptocurrencies

- Some users may experience delays in transactions

What is Perfect Money?

Perfect Money is a digital payment platform founded in 2007. It allows you to send and receive money, make online purchases and invest in various projects. Perfect Money supports many currencies, including US dollars, euros and pounds sterling. Perfect Money is popular among online traders and investors in financial projects.

Pros of Perfect Money

- Supports many currencies

- Popular with online traders and investors

Cons of Perfect Money

- High transaction fees

- Some users may experience delays in transactions

- Limited payment options

What is Payeer?

Payeer is an electronic payment platform that allows you to make online payments, transfer money and buy/sell cryptocurrencies. It was founded in 2012 and is based in Georgia. Payeer supports many currencies, including US dollars, euros and rubles. Payeer also has low fees. Payeer is popular among online merchants and traders.

Pros of Payeer

- Supports multiple currencies

- Low transaction fees

- Allows users to withdraw funds to other payment systems

Cons

- Limited customer support

- Some users may experience delays in transactions

- Not as widely accepted as other payment platforms

What is Skrill?

Skrill is an electronic payment system that allows you to make online payments, transfer money and buy/sell cryptocurrencies. It was founded in 2001 and is based in the UK. Skrill supports many currencies and has low transaction fees. It also has a VIP program that rewards loyal users with benefits such as lower fees and increased transaction limits. Skrill is popular among online players and traders.

Pros of Skrill

- Over 40 currencies and offers various payment options such as credit/debit cards, bank transfers and mobile wallets.

- VIP program for high volume users that includes lower fees and priority support.

- High security measures to protect transactions and personal information of users.

Cons of Skrill

- Transaction fees may be higher than other payment platforms.

- Customer support may be slow and unresponsive.

- Skrill requires users to complete a verification process before they can use certain features, such as sending and receiving large amounts of money.

- Inactivity fee of €5 per month from accounts that have not been used for more than a year.

Referral program

All payment services have a referral program that allows users to earn money by inviting their friends to use the platform.

Conclusions

Each platform has its pros and cons, and what works for one user may not work for another. Before choosing a payment platform, it is important to evaluate your specific needs such as transaction fees, currency support, security, and ease of use.

If you are looking for a payment platform with low transaction fees and support for multiple currencies, Volet or Payeer may be the right choice for you. If you value security and reliability, a regular bank transfer may be your best option. If you prefer a newer platform with competitive exchange rates and a user-friendly interface, Wise Transfer might be a good choice.

Ultimately, choosing the best payment platform for you will depend on your individual needs and preferences. We hope this article has provided valuable information to help you make an informed decision.