Sending money abroad can be painful. It is long, expensive, bureaucratic and inefficient. This has changed with Wise (formerly known as Transferwise).

Wise is an online platform for sending and receiving money around the world. It’s simple, transparent and cheap. In this article, you will find a comprehensive overview of Wise.

As a bonus, I also checked Wise reviews on different reputable review platforms and summarized each one towards the end of the article.

Wise Cost Calculator

The fee calculator has a user-friendly interface so you can quickly figure out how much you are likely to pay when sending amounts in different currencies. We can offer accurate information with minimal effort, saving you a lot of time and money.

Реальная стоимость отправки EUR в USDKey Benefits of Wise (TransferWise)

Wise, formerly known as TransferWise, allows you to carry out transfer procedures without bureaucracy. In addition, you can get the most competitive exchange rates transparently and transfer funds easily.

- Wise, formerly TransferWise, is an international money transfer service.

- Easy to set up an account, log in and make a transfer

- It has very competitive exchange rates with no markup

- It has low transfer fees

- Wise Cost Calculator makes it easy and transparent to view rates and fees

- You can send money to over 80 countries

- Well organized phone support limited to regular business hours

- Delivery of funds may be slow or fast depending on the service chosen

- Fast transfer possible using debit or credit card

- Transferring funds from bank accounts may take several days

How does Wise work?

Wise is simple and intuitive, there is no special secret in its work.

Once you create an account and log in, Wise will let you transfer. You simply select the currency and amount you want to send, as well as the currency you want to convert to, and it will give you the best exchange rate available, as well as the transfer fee.

Wise saves you money by taking a small percentage of the transaction instead of paying a credit card transaction fee or a bank transfer fee. Wire transfer fees can be up to 5% hidden fees, and Wise is advertised as being 8 times cheaper than banks.

How long does a money transfer take?

There are many factors that affect the speed of international money transfers with TransferWise. For example, currencies used, amount, day of the week, time of day, verification, payment method, personal or business transfer.

In addition, the speed of transfers is one of the key things that TransferWise is constantly improving. For example, transfers made among the most common currency routes (GBP → EUR) can actually be delivered to your bank account in just a few minutes.

Wise transfers usually take from a few minutes to two business days.

To receive money faster: If you send money using “instant” payment methods (such as a debit or credit card), Wise will immediately receive the money and the transfer will be sent to your bank account immediately!

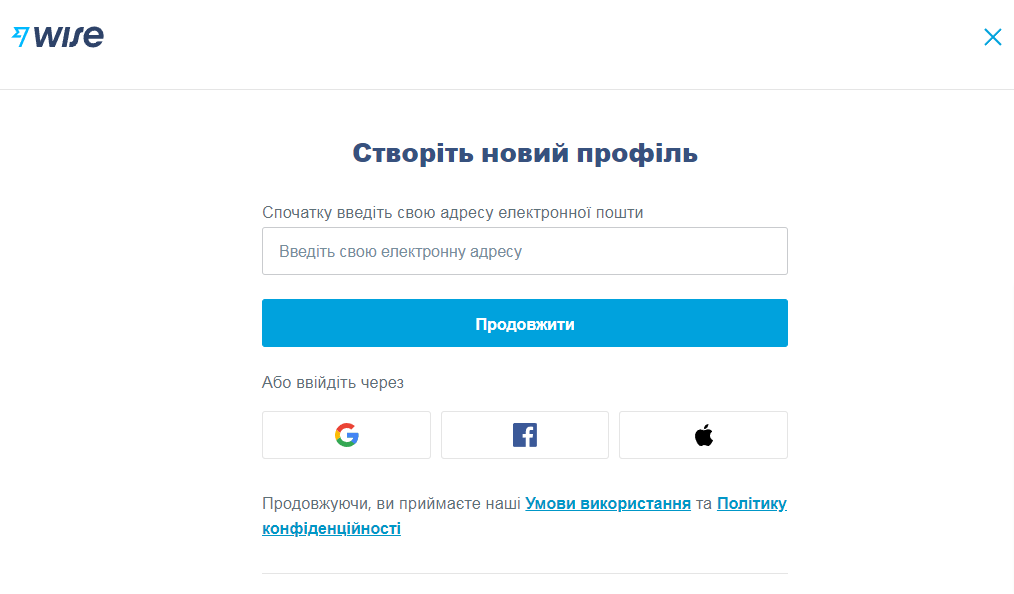

How to open a Wise account

You just go to the Wise website and sign up for free. It will ask you for your email address and password, and voila, your account is open!

Here’s how easy it is to sign up for a Wise account:

- Go to Wise.com .

- Click Register.

- Enter your email address, create a password and select your country of residence.

- Verify your identity using government-issued ID. (This is required to comply with requirements set by the Financial Conduct Authority (FCA) in the United Kingdom, the Financial Crimes Enforcement Network in the United States, and other international bodies.)

You will need to add money to your Wise account using a bank account, Apple Pay, credit or debit card. Wise accepts Mastercard, VISA and some Maestro cards.

You can then start transferring money from that account or getting paid using your Wise account.

Wise Fares and Fees

Before using Wise to send money abroad, you should better understand how currency conversion works and what fees apply.

Fees

Wise uses the real exchange rate for translation. TransferWise costs between 1% and 2.5% per transfer.

What determines the Wise commission?

Three things determine the total fee you pay with Wise: the amount you send, the payment method, and the exchange rate.

The amount you send – the more you send, the more you pay as it is based on a percentage system.

How you pay – The most expensive payment method is credit card, then debit card. Wire transfers are the cheapest for transfers over $1,700 due to the lower exchange rate offered.

An exchange rate is the rate you pay to exchange one currency for another, which is determined by global market forces. It can be easily seen on Google and is known as the market rate or mid market rate. Wise charges a conversion fee slightly above the market rate of 0.3-3%, banks typically charge a retail rate of 3-6%.

Hidden fees

Wise has no hidden fees.

However, there are fees that add up to the real exchange rate. The difference is that Wise transparently informs users of what fees they charge, line by line, unlike other financial institutions that hide all of these fees.

How to avoid Wise fees?

Refusing to pay by credit or debit card is a way to avoid Wise fees. A credit card is always the most expensive way to send money abroad, followed by a debit card.

How to register a PAYEER wallet and deposit without commission

How to transfer money to Wise (formerly TransferWise)

Once registered, make a money transfer from your Wise account as follows:

- On the website, go to the main page and select “Send Money”. If you are using the app, click Submit.

- Enter the amount you want to transfer.

- Specify the type of transfer, such as personal transfer or business transfer.

- Fill in your personal information.

- Fill in the account details and the recipient’s account number.

(You can provide their bank details or email address. If they have a Wise account, the money will be transferred to it. If they do not have a Wise account associated with the email address you provided, Wise will send them an email asking for bank details. requisites).

- Review the transfer details and add an optional link to the recipient.

- Select the type of transfer and payment method. Wise will tell you the commission for each option and the estimated time within which the money will arrive.

Wise will send you a confirmation email or a mobile app notification. They will also inform the recipient that the money is on its way.

How to get money in Wise (formerly TransferWise)

To receive money from Wise, you must have a local bank account and be prepared to accept payments in your local currency. With Wise, you will always send money in your country’s currency, and the recipient will receive the payment in their own currency.

For example, let’s say you’re making a transfer from Poland to PLN to a recipient in Ukraine. Although you make a payment from your account in Poland in PLN, the recipient will receive money in their Ukrainian account only in their local currency – Ukrainian hryvnia.

This works the same for every country on the list where the money goes.

Using Wise (formerly TransferWise) for business payments

You can also make a Wise money transfer for your business.

First you need to set up a business profile in Wise. They will ask you to provide some basic profile information. You will then go through a verification process to make sure you are who you say you are.

Once your business profile is set up, you can start transferring money. Just remember that if you set up your transfer as a business payment, it must come from your business account.

Multi-Currency Account and Wise Debit Card

Wise also offers a low-fee multi-currency account that replaces the TransferWise account and the Wise Business account.

Both accounts operate as multi-currency accounts without borders, allowing you to store, send, receive and spend money just like in a traditional financial institution.

For international transactions using a multi-currency bank account, Wise charges a flat fee and a conversion fee when sending to another currency.

With this limitless account, you can also request a Wise debit card. A debit card allows you to spend money anywhere in the world using the real exchange rate (mid-market exchange rate). Therefore, you will not pay any additional hidden fees.

Who is Wise suitable for?

This is suitable for individuals and institutions that transfer money internationally. As for individuals, Wise is ideal for:

- Sending money to family and friends abroad

- Sending money between your bank accounts in different countries

Is it safe to use Wise (TransferWise)?

Wise is a licensed financial institution regulated by the Financial Conduct Authority (FCA) and HM Revenue and Customs (HMRC) in the UK. Both entities provide institutional grade security and encryption (256-bit SSL data with a 2048-bit key).

In addition, funds in consumer accounts are kept separate from funds in corporate accounts. In the event of financial difficulties or bankruptcy, consumer funds are protected.

History Wise

Wise was founded as a fintech startup in London in 2011 by two financial gurus, Taavet Hinrikus and Christo Kaarmann, who have impressive financial and business backgrounds.

The investors backing Wise are no less impressive and include IA Ventures, Index Ventures, Seedcamp, Kima Ventures, Virgin Group’s Sir Richard Branson and PayPal founder Max Levchin.

Since its inception, Wise has completed seven rounds of funding totaling over $396 million.

Wise support

You can contact customer support by phone only on weekdays, during normal business hours. This is also standard for most financial institutions, but nevertheless, it is worth paying attention to.

Wise pros and cons

Wise makes it easy and fast to send money abroad to friends, family, or even make purchases abroad.

If you are looking for a comprehensive money transfer company, Wise is a good choice. They offer services in 80 countries and 50 currencies. Wise Money Transfer also has no hidden fees or markups and you will pay reasonable and transparent fees. Not to mention that they operate at mid-market rates, which is fair and can save you money on currency conversions in the long run.

Pros of Wise

- Safe to use

- Many countries and currencies

- No bureaucracy

- Favorable exchange rates

- Low fees

Cons Wise

- Transfers can be slow

- No cash withdrawal

- Phone support is limited

Can Wise be used for online shopping?

The Wise Card can be used to pay for goods and services wherever debit card payments are accepted. You can also use it to shop online.

You can change your card spending limits on the website or in the Wise app

Can I use Wise as a bank account?

Wise started by providing cheap international bank transfers at favorable exchange rates. With a multi-currency account, it now offers a modern banking alternative.

Is Wise suitable for transferring money abroad?

Wise is a great choice for sending money abroad. International money transfers make up the majority of complaints from bank users. Banks and intermediaries never miss the opportunity to charge high fees when sending and receiving money from other countries.