After Perfect Money ceased its operations in 2025, I would advise paying attention to Volet (formerly AdvCash) as a good and modern alternative. Here’s why I switched to Volet myself:

- Multi-currency and crypto support: You can work with a bunch of fiat currencies (USD, EUR, RUB, UAH and more than ten others) and cryptocurrencies like BTC, ETH, USDT, and all of this is quickly converted.

- Global coverage: Volet is available in more than 150 countries.

- Debit cards: Issuance of plastic and virtual Visa/Mastercard cards in USD, EUR, RUB with direct replenishment from the balance.

- Free P2P transfers: Instant transfers between Volet users without fees.

- Business tools: There is an API for payouts, you can quickly set up payment processing on your website (within a day) and fees are fixed, with no hidden charges.

- Swapper for the crypto market: You can be among the first to trade new tokens that have the chance to grow significantly.

I personally use Volet for international transfers and for withdrawing funds from exchanges. Everything works quickly (money reaches the card within 3 hours) and the fee structure is clear. In my opinion, for freelancers and traders, this is an excellent option after Perfect Money.

Fees: P2P – 0%, card withdrawals – from 0.5%, business payments – from 1.9%. Verification is completed in less than a day.

Full analysis of the company and service capabilities can be read in the article: Volet (formerly AdvCash): Complete review in 2025 – Registration, Cards, Crypto, and Money Withdrawal

Perfect Money is one of the most popular payment systems. It was created in 2007 as a tool for transferring money between people participating in online earning programs. It is currently an online wallet used primarily for forex, binary options, sports betting and monetization of high risk programs. Using the PerfectMoney payment system is completely free, and external transfers are charged with one of the lowest commissions on the market. How does the payment system work and what do you need to know about it?

What is Perfect Money?

Using the Perfect Money wallet and registering on the site is very simple. However, we must remember that, as with other sites dedicated to our finances, here we must verify your identity. It is best to do this at the very beginning, immediately after registration.

In perfect money, we can store funds in foreign currency accounts opened for us, transfer funds between users, as well as receive and pay for various types of services via the Internet. The big advantage of Perfect Money is the fact that with this system we can process payments in many different ways. Starting from US dollars or euros and ending with cryptocurrencies and even gold!

Perfect Money is mainly used by people who are serious about making money online, especially on high risk sites. This is because most of these projects do not allow you to withdraw money directly into your bank account. When it comes to Forex markets, binary options or sports betting, this is one of the most commonly used online wallets, however, it is also used by gaming platforms.

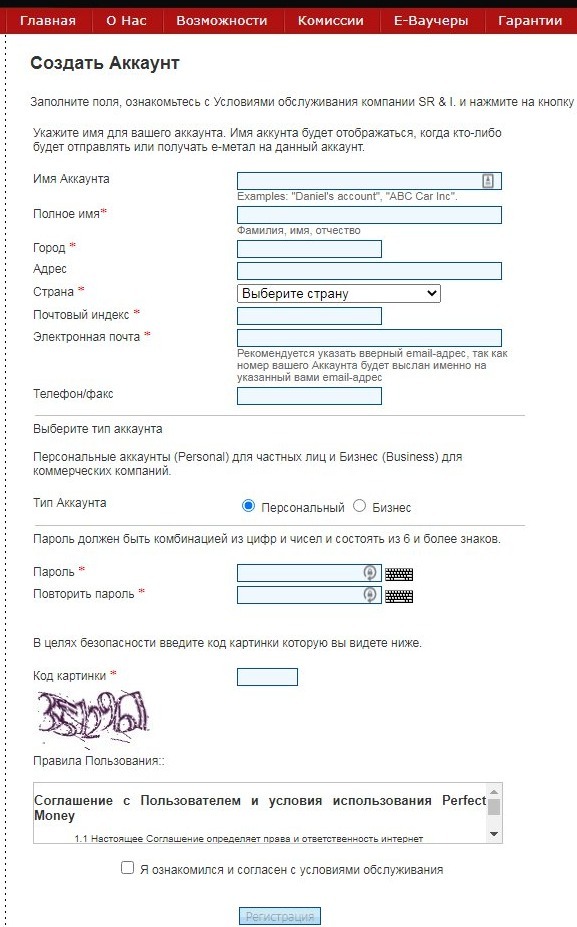

Registration Perfect Money

Registration in PerfectMoney is extremely simple and does not require additional explanations. Specify your real data, otherwise you will not be able to verify the wallet and will pay an increased commission. Fill in all the required fields, select the type of account – Personal.

To register in PerfectMoney – click on the picture.

Perfect Money ID

Most online wallets use a username and password to log in, but not Perfect Money. Here we have an identifier that we will receive after registration to the specified email address. It is best to write down this number somewhere, as you will need to log in. Of course, in addition to the ID, you will need a password, but you can come up with one yourself.

Perfect Money verification

Account verification is not required, but without it, account use will be very limited. It’s also worth doing because of the lower fees compared to an unverified account. Of course, we will also have to go through this if we want to transfer money from the payment system to a bank account. The verification process consists of 3 steps:

- We send a scan of an identity document, that is, one that contains a photo. We can send passport or driver’s license,

- We send a scanned utility bill (water, electricity or gas) indicating our address,

- We confirm the phone number. The whole process is to enter a 4-digit code that we will hear on the phone. Obviously in English , so this might be a problem for some. The code that we hear must be entered in the appropriate field on the site.

After completing these 3 steps, your account will be verified.

How to withdraw money from Perfect Money

When it comes to withdrawing and replenishing money from the payment system, there are several ways to do it:

- Bank transfer (only from 300 USD),

- Cash deposits or withdrawals – deposits are processed by local exchangers,

- e-voucher – replenishment of the account with a special code that can be purchased at various sites or using the available funds on the wallet to create such a voucher.

- Exchange offices – payment or withdrawal through online exchange offices . This option allows you to make transactions between different wallets, for example from Perfect Money to AdvCash and vice versa. Of course, an additional fee must be taken into account here, because these are services that do not depend on PM,

- Bitcoin wallet allows you to store this cryptocurrency, so the ability to send it to (and from) a wallet should not come as a surprise,

- Exchange of funds between users (loans are also possible, but more on that below).

Of course, it is worth mentioning another form of payment – payments from profitable sites and HYIPs. Perfect Money is popular in gray schemes and is often used by high-risk projects and outright pyramid schemes. Therefore, we will not see Perfect Money as a wallet for payments in legal companies, but if you already saw its presence in your project. Be very careful about your funds and the “tempting offer” that you received.

Perfect Money fees

Creating an account on the platform is completely free. However, Perfect Money charges a fee for transfers made using this payment system.

This fee depends on whether the account is verified or not.

Fees for a specific type of transfer:

| Bank transfer | from 0.5% |

| Bitcoin | 0% |

| Currency exchange | |

|---|---|

| USD/EUR, EUR/USD | At market rate |

| Percentage | |

| Interest accrual on account balance: | 4% per annum, (Maximum 500 USD per month) |

| Translations | |

| Internally | premium account 0.5% verified account 0.5% unverified account 1.99% |

| Withdrawal fees | |

| Bank transfer | from 2% + bank commission |

| Bitcoin | Express (immediate) 0.5% + $10 |

| Fees for using security tools | |

| SMS informing | $0.1 |

| Annual maintenance | $0 |

| Account Recovery | $100 |

Funding fees

When choosing a voucher, the commission is the same as for a bank transfer.

Perfect Money interest rate

Of course, the payment system deserves a big plus for accruing interest on all funds placed in the wallet. This is an interesting way to save, mainly due to compound interest and capitalization of funds. It is also worth noting that the interest rate of 4% per annum significantly exceeds those offered, for example, on bank deposits in foreign currency in Ukraine, Russia and Kazakhstan.

Moreover, PM is indeed one of the few platforms of this type that allows its users to earn money without making any transactions.

Credits and loans Perfect Money

Perfect Money also allows you to borrow money from others or take a loan from other users. As with loans, each has an associated interest rate, so in theory we could even make money off of it. We can place offers both as a lender and as a borrower, and then wait only for those who are interested.

Unfortunately, many users of the payment system do not return borrowed money , so it is worth checking your account in advance and checking your reputation, although this does not give any guarantees. When choosing this form of earning or looking for a loan, it is better to choose other sites.

Referral program

The payment system also has an affiliate program, although it is a little hidden. For each invitee, we receive 1% of the minimum monthly balance once a year. We can find our referral by going into “history”, although we can also use our ID to create such a link manually. It will look like this: https://perfectmoney.is/signup.html?ref=ID , where instead of “ID” we have to provide only our own number (same as for login).

Where PerfectMoney is registered

Although we can complain, as it is about the safety of use – especially with regard to transparency. Of course, if Perfect Money were unfair to their customers, we would not recommend or review this payment method here. However, among all reliable online wallets, Perfect Money is saddled with the greatest “mystery” – and this has never been something good in the world of finance.

The main problem is that we don’t know who owns this brand, and worse, we don’t even know what country this company is registered in. There were rumors that the company’s headquarters were in Panama, although these doubts have already been dispelled by the government of Panama.

Also, there is an assumption that Perfect Money is located at this address: Unit 1213, 12/F, Wing On Plaza, 62 Mody Road, Tsim Sha Tsui East, Kowloon, Hong Kong. But it is not exactly.

Perfect Money has been offering its services for over 12 years and it’s hard to have any reservations about their quality, although the absence of any information about the establishment of this company can be a source of concern.

Perfect Money Reviews

The wallet has good reviews on the Internet and is considered reliable. The interest rate on the account is definitely a big plus, which is rarely the case with online wallets. In fact, it is probably the only payment processor that earns interest. Another interesting solution is internal loans, but unfortunately they need to be improved. Very good idea, but there are often problems with refunds.

When visiting the Perfect Money website, we can notice the not very professional design of the platform – as we remember the website from a decade ago. However, the platform offers its users a lot of possibilities and, contrary to its appearance, is really vast.

Pros of Perfect Money

- Many ways to fund your Perfect Money account

- 4% per annum on the balance of funds on the balance sheet

- Widely used payment method on Forex platforms

- The company has been around for 12 years and gets good feedback from the community.

Cons of Perfect Money

- US users not accepted

- High withdrawal fees – even up to 2%

- Old site design

- No mobile app

Conclusions

The Perfect Money platform has been on the market for a long time and there are no signs that it is dishonest. However, it is understandable why customers often choose AdvCash or PAYEER . The choice of online wallets on the market is very large. If this brand does not offer anything special other than competition, it is better to store your funds in a payment system where there are not many “red flags”.

If you are into Forex, sports betting or HYIPs, then PerfectMoney is your choice. Just register your Perfect Money wallet and start using it.