Have you heard about a crypto exchange that, on the one hand, obtains licenses in the strictest jurisdictions, and on the other – stays silent about the size of its insurance fund? This is OKX. On the surface, it’s a tech giant with a bunch of trading bots, low fees, and a good reputation. But if you look closer, you’ll see a complex structure with offshore registration, a controversial past, and risks that could cause a trader to lose all their money.

So what exactly is OKX? Is it a cool earning platform suitable for pros, or just another house of cards that will collapse under any serious crisis? I looked into this project to share my opinion. This is not advertising, but a hardcore analysis based on facts, data, and hidden threats.

⚡ Important Update (August 2025): The OKB Token Revolution

Before we continue, it’s necessary to mention one important event. In August 2025, OKX significantly changed its OKB token:

- Token Burn: The exchange permanently destroyed over 65 million tokens (according to blockchain data – nearly 279 million).

- Fixed Supply like Bitcoin: The total number of OKB was capped at 21 million, and no new tokens are issued.

- Market Reaction: The price of OKB surged by 160% and reached an all-time high – over 135 dollars.

This is not just a technical update, but an attempt to create scarcity and make OKB similar to Bitcoin. Now the token price depends not only on fee discounts but also on speculation. Keep this in mind as we analyze the system.

Transparency: Corporate and Regulatory

Here we will learn about who is behind OKX and whether you can trust their legal structure. This is important; otherwise there is no point in analyzing the trading tools.

Jurisdiction and Licenses: Regulatory Blitzkrieg

OKX is playing a double game. On one hand, their main office is located in the Seychelles – a classic offshore jurisdiction that would raise suspicions with any investor. This allows them to offer high leverage and complex derivatives without too many questions.

But after the collapse of FTX, OKX began obtaining licenses in serious jurisdictions to improve its reputation and attract major investors.

- European Foothold (MiCA): In January 2025, OKX obtained a MiCA license in Malta, which opened up access to 28 Eurozone countries. You can check the license status here: Malta Financial Services Authority (MFSA).

- Middle Eastern Expansion (VARA): OKX received a preliminary license from Dubai’s Virtual Assets Regulatory Authority (VARA) to strengthen its position in the Middle East. Information on licensed providers can be found here: Dubai Virtual Assets Regulatory Authority (VARA).

- Presence in the USA (FinCEN): It’s important to understand that OKX and Okcoin USA are separate companies. Okcoin USA Inc. is registered with the Financial Crimes Enforcement Network (FinCEN) and holds licenses in some states. This protects the main business from American regulators but creates a two-tiered system. You can check the registration here: Financial Crimes Enforcement Network (FinCEN).

Conclusion: OKX is a hybrid. They use offshore flexibility to work with derivatives worldwide while at the same time building a reputation as a law-abiding company in major financial centers. It’s smart, but risky. For a trader, this means that depending on the country, you will be dealing with different legal entities and varying levels of protection.

We would like to believe that by 2025, OKX’s level of financial transparency will become the norm. Unfortunately, however, there are still platforms on the market that ignore basic transparency requirements, creating risks for users. How can you spot these “dark horses”? Read our analysis of the Freedx exchange.

Management and Reputation: Shadows of the Past

OKX is led by Minxin “Star” Xu, who started with the Okcoin exchange in China in 2013. After regulatory tightening, the company had to leave China. Now key positions are held by Star Xu (CEO), Hong Fang (President), and Haider Rafik (CMO). The appointment of Roshang Robert (former Barclays top manager) as CEO of the American division indicates serious intentions in the US market.

But their reputation is not spotless. In 2018, there was a case where the liquidation of a large futures position not only led the exchange to inject 2,500 BTC into the insurance fund, but also to withhold 17% from profitable traders to cover losses. It happened a long time ago, but it serves as a reminder of how risk management mechanisms operate in extreme situations.

Financial Stability and Security: A Glass Fortress?

Here we will check whether you can trust OKX with your money. This is the most important section.

Proof of Reserves: The Gold Standard

After the collapse of FTX, many exchanges began to show their reserves, but OKX went further than anyone. Their monthly Proof of Reserves (PoR) program is one of the most advanced on the market.

- Technology: Instead of a Merkle tree, OKX uses zero-knowledge cryptography (zk-STARKs). This allows them to prove the existence of funds without revealing user data. This is a big step forward in terms of privacy and reliability.

- Independent Verification: Audits are conducted every month by independent companies such as Hacken, which confirm that the reserves are always above 100%.

- Open Source: OKX provides tools on GitHub so that any technically inclined user can verify their claims.

Conclusion: In terms of solvency, OKX sets the standard for the entire industry. The risk of a sudden collapse like FTX’s is minimal.

Cybersecurity and Incidents: The Achilles’ Heel

Despite the technology, OKX’s history of incidents shows a weak spot – the human factor and processes.

- Account Hacks in June 2024: Several accounts were hacked due to social engineering. Hackers used fake “legal documents” to trick support and gain access to user data in order to create new API keys. OKX compensated the losses, but the incident revealed weaknesses in their internal verification procedures.

- The Lazarus Group Incident: The exchange had to suspend its DEX aggregator because North Korean hackers used it for money laundering. This highlights risks not associated with the main CEX, but with its DeFi products.

These cases show that while OKX’s reserves are transparent, their processes (document verification, customer support) may be vulnerable. You are not only trusting the code, but also the people who can make mistakes.

Insurance Fund: The Black Hole

And here is where it gets most interesting. Unlike Binance with its SAFU fund of 1 billion dollars or Bitget, OKX does not provide any information about the size or composition of its insurance fund. The last mention was in 2018, when 18 million dollars were injected into it.

This is a very alarming signal. If a major hack occurs that the exchange cannot cover, there will be no pre-allocated funds to compensate users for their losses. This is a huge risk.

Trading Ecosystem: Seeking Advantages

Now let’s assess OKX’s opportunities for traders.

Trading Conditions and Costs

OKX is one of the cheapest exchanges for active traders, especially in the derivatives market.

- Fees: For regular users, spot fees start at 0.08% (maker) / 0.10% (taker), and for futures – 0.02% (maker) / 0.05% (taker). This is on par with or even better than Binance and Bybit.

- VIP Levels and OKB: The biggest advantages are granted to large traders and OKB holders. At high VIP levels, maker fees become negative, meaning the exchange pays you for liquidity. This attracts market makers and algorithmic traders.

- Liquidity: OKX is among the top 3 exchanges by trading volume, so they have good liquidity on major pairs, reducing slippage even in large transactions.

Opportunities for Earning and Capital Management

- Passive Income Products (“Earn”): OKX offers various ways to earn: from flexible savings accounts (3-6% APY) to fixed-term staking (up to 25% APY) and liquidity pools. Yields are generally stable (staking, lending).

- Launchpad (Jumpstart): In the past, IEOs on OKX showed average yields, lagging behind Binance Launchpad. But after changes in OKB tokenomics and the launch of the X Layer blockchain, the platform has become more attractive to good projects. There is reason to believe that IEO yields on OKX will increase.

Unique Features

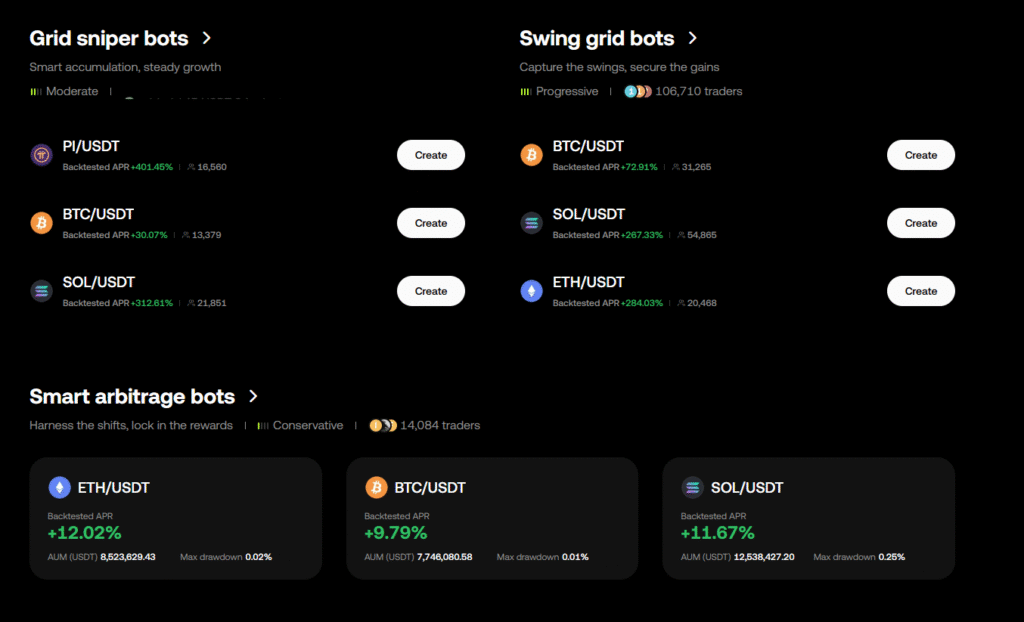

- Built-in Trading Bots: This is OKX’s main advantage for regular and semi-professional traders. The platform offers more than 10 bots, ranging from grid (Spot/Futures Grid) to DCA (based on Martingale) and arbitrage bots. This speaks to the reliability of the trading engine and API.

- Integration with Web3: OKX is building an entire ecosystem: CEX + non-custodial wallet (OKX Wallet) + blockchain (X Layer). This allows users to easily switch between centralized and decentralized finance.

- Pre-Market Trading: For the most risk-taking traders, OKX offers trading futures on tokens even before their official listing. This is a very volatile market with low liquidity, but the potential for high profits is there.

The mass burning of OKB tokens and the restriction on issuance led to an increase in its price, but also shifted the focus to speculation. It is interesting to compare this with the tokenomics of other major exchanges, where tokens are mainly needed to reduce fees and gain access to exclusives. Read more about this in our Bitget review.

Conclusions

SWOT Analysis for the Trader

- Strengths:

- Transparency of reserves (Proof of Reserves).

- Very low fees on derivatives.

- A multitude of built-in trading bots.

- Good liquidity in key markets.

- MiCA license in the EU.

- Weaknesses:

- No information about the insurance fund.

- Security vulnerabilities.

- Inconsistent support.

- Mediocre performance of the IEO platform.

- Opportunities:

- Use trading bots for automation.

- Increase IEO yields after the OKB update.

- Use X Layer as an inexpensive entry to DeFi.

- Earn on OKB as a deflationary asset.

- Threats:

- Inaccessibility in the USA, United Kingdom, and other countries.

- Risk of account hacking via customer support.

- Risk in the event of a major hack due to an opaque insurance fund.

Final Recommendation

OKX in 2025 is a platform with low risk and high yield. They possess the tools, liquidity, and transparency of major exchanges, yet still carry risks similar to offshore exchanges.

- Who It’s For:

- Systematic and algorithmic traders: Thanks to a reliable API, low fees, and good liquidity.

- Active derivatives traders: High leverage, a range of instruments, and low costs.

- Traders using bots: A plethora of built-in bots for automation.

- Who It’s Not For:

- Long-term investors: Risky to store large amounts due to the opaque insurance fund.

- Beginners: A complex platform and slow support.

- Traders from the USA, United Kingdom, and other restricted countries: No full functionality access.

- Advantages:

- Transparency of reserves based on zk-STARKs.

- Trading bots.

- OKB 2.0 tokenomics.

- MiCA license in the EU.

OKX has some of the lowest fees on the futures market, but other giants are also competing for traders. To get the full picture, compare the terms and conditions with those of its main competitor. Who will win this race? Find out in our 2025 Bybit review.

Answers to Comments

Comment from “CryptoSkeptic”:

All this “transparency” is just for show. In 2024, they were siphoning off money, and now you’re talking about security. And where is the insurance fund? Until I see an audit of a billion-dollar fund, this is just marketing.

My response:

You’re right, these are two different things. PoR proves that for every dollar a client deposits, the exchange holds a dollar in reserves. This protects against bankruptcy like FTX’s. However, in June 2024, their identity verification processes proved vulnerable. The risk of the exchange’s collapse is low, but the risk of an account hack is real.

The insurance fund remains the main risk. Your comparison with Binance is valid. We simply have to trust that OKX will have sufficient funds in the event of a major hack. This is unacceptable. It may be suitable for active trading – but storing large sums is questionable.

Comment from “TraderAlisa”:

Thanks for the analysis! I use grid bots. What advantages do OKX’s bots have compared to 3Commas or Bitsgap on Binance? And how reliable is their API?

My response:

The advantages of OKX’s native bots:

- Speed and Reliability: Built-in bots run on the exchange’s servers, eliminating delays.

- No extra costs or risks: You don’t have to pay for a subscription or share API keys with a third party.

- Diversity: OKX offers unique types of bots.

The existence of such a robust set of bots indicates that their API is very reliable and designed for high loads.

Comment from “OKB_Hodler”:

I bought OKB at 40 dollars and I’m in profit now after the burn news. I believe it is the best exchange token on the market. You mentioned that their IEOs were average. Don’t you think that now they will surpass Binance in terms of the quality of projects on the launchpad?

My response:

Congratulations on your investment! You’re right, the situation has changed.

The combination of a “strong OKB token + X Layer blockchain” creates a powerful effect.

- For projects: Launching on a platform backed by a strong token and community becomes more attractive. X Layer offers an inexpensive environment for dApps.

- For investors: Participating in IEOs becomes more valuable since OKB is a strong investment.

Can OKX surpass Binance? Binance is a huge machine, but I’m confident that the gap in project quality will narrow. OKX has created conditions to attract good projects.