Money transfers are an integral part of our daily lives and for a long time traditional banking systems dominated the market. However, in recent years, a new player has emerged that has shattered the status quo and that is Wise.

Wise peer-to-peer model

One of the ways Wise is changing the traditional banking system is through the peer-to-peer model. This model allows customers to transfer money directly to each other, eliminating the need for intermediaries and reducing transaction costs. Unlike traditional banks that often charge hidden fees and markups on exchange rates, Wise offers fair and transparent rates, which can help customers save money.

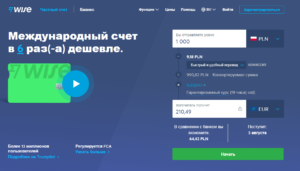

Let’s say Andrew wants to transfer $3,000 from his US bank account to his friend Mary’s UK bank account. Using a traditional bank, Andrew may end up paying $160 or more in fees. However, using Wise, Andrew will only pay a fraction of this amount, as Wise uses the mid-market exchange rate that banks use when they trade with each other. This means Andrew will receive a fair and transparent exchange rate and Mary will receive the full amount with no hidden fees.

Реальная стоимость отправки EUR в USDMulticurrency accounts

Wise Borderless Accounts is another way the company is disrupting the traditional banking system. These accounts allow customers to hold money in multiple currencies and easily switch between them as needed. This is especially useful for clients who travel frequently or do cross-border business.

Let’s say Ana is a freelancer working with clients all over the world. Using a traditional bank, Anya may have to open multiple accounts in different countries, which can be time consuming and costly. However, with a Wise multi-currency account, Ana can store money in different currencies and easily switch between them as needed. This will help her save time and money, as well as simplify financial management.

API for business

The Wise API is another way that Wise disrupts the traditional banking system. This API allows businesses to integrate the Wise payment system into their own software applications, which can help them save time and money on international payments.

For example, suppose ABC Company is a US enterprise with customers around the world. Using a traditional bank, ABC Company may have to make many wire transfers to different countries, which can be time consuming and costly. However, using the Wise API, ABC can integrate its payment system with Wise and make international payments quickly and easily.

Saving money

According to a study by Consumer Reports, Wise was 8 times cheaper than traditional banks for international money transfers. This means users can save significant amounts of money by using Wise instead of traditional banking systems.

TransferWise is not only cost effective, but also offers fast and convenient services. The quick setup process and fast data transfer make it easy for users to send and receive money even across borders. In addition, Wise is available in multiple countries and currencies, making it accessible to a wide range of users.

Wise is a platform that is changing the traditional banking system. With low fees, transparency, convenience, security, and exceptional customer service, it’s no surprise that TransferWise has quickly become the go-to choice for people who make frequent international money transfers. If you haven’t tried Wise yet , now is the time to take a look at its many benefits and see why it is quickly becoming a popular money transfer platform.