In the world of cryptocurrencies, where platforms appear and disappear, choosing the right exchange is a serious decision that affects the security and growth of your assets. Let’s figure out what WhiteBIT is—a crypto exchange with Ukrainian roots that plans to become the largest in Europe by 2025. What stands behind these ambitions? Can you trust it with your funds, and will a trader gain any advantage here?

This analysis will help answer two main questions that are important for every market participant:

- How reliable is it? We will examine the security, regulatory compliance, and financial stability of WhiteBIT. After all, the risk of losing capital is unacceptable.

- Where can you earn here? We will take an in-depth look at the trading ecosystem of the exchange: fees, API, crypto card, and passive income opportunities. What tools does WhiteBIT offer that allow you to earn more?

So, let’s see if WhiteBIT will become your main trading platform or if it will turn out to be just another attractive facade in the world of cryptocurrencies.

Subject of the study (as of 2025):

- Exchange Name: WhiteBIT

- Main Domain: whitebit.com

- Native Token: WhiteBIT Coin (WBT)

- Management: Vladimir Nosov (Founder and CEO)

- Information: The largest European centralized crypto exchange, founded in 2018 in Kharkiv, Ukraine. By 2025, WhiteBIT Group serves over 35 million clients, of which 8 million are exchange users. The platform offers more than 700 trading pairs and supports over 330 digital assets. The company is developing its own ecosystem, including the Whitechain blockchain, the WhiteBIT Nova crypto card, and the non-custodial wallet Whitewallet, with a focus on compliance with EU regulations.

Security Assessment – Can You Trust WhiteBIT with Your Capital?

Before we talk about trading opportunities, it is important to understand whether your money might vanish. This is a primary concern.

Transparency: Corporate and Regulatory – Betting on Europe

WhiteBIT is not just another “offshore” exchange. Since its establishment in 2018, the company, founded by Ukrainian entrepreneur Vladimir Nosov, has chosen the path of legalization in Europe. It is important to note that the founder’s background is not associated with scandalous crypto projects, which positively affects the reputation.

By 2025, WhiteBIT is a network of companies oriented towards European legislation. The key operating unit is UAB Clear White Technologies, registered in Lithuania and regulated by the Financial Crime Investigation Service (FCIS).

WhiteBIT did not limit itself to one license and has received more than 10 VASP (Virtual Asset Service Provider) authorizations in key EU countries, including:

- Spain (under the supervision of the National Securities Market Commission (CNMV), cnmv.es)

- Poland (under the supervision of the Polish Financial Supervision Authority (KNF))

- Czech Republic (regulated by the Czech National Bank (CNB))

- Bulgaria (crypto companies are required to register with the National Revenue Agency (NRA))

This strategy is preparation for the pan-European MiCA (Markets in Crypto-Assets) regulation. WhiteBIT aims to operate completely within a regulated framework, which could attract institutional clients. At the same time, the exchange restricts access for users from jurisdictions with high risk or uncertain status, including the USA, the UK, and Canada.

Financial Stability: WhiteBIT’s Weak Spot

Proof of Reserves: “The Black Box”

This is where WhiteBIT’s main drawback lies. In 2025, after the collapse of FTX, cryptographic proof of reserves (Proof of Reserves, PoR) became a standard of trust. PoR allows a user to verify that the assets on the exchange actually exist.

WhiteBIT does not publish Proof of Reserves data, relying instead on external audits by Hacken. As a result, the company, while investing in cybersecurity, does not give users the opportunity to verify the existence of their funds. You are forced to trust the exchange and its auditor without independent verification. For investors holding large sums on the exchange, this might be unacceptable.

Insurance Fund: It Exists, But It’s Not Transparent

WhiteBIT claims to have an insurance fund of $30 million to protect users’ assets. The fund is replenished through trading fees. This is a plus.

However, there is no information about the composition of the fund’s assets. If it consists of the exchange’s native token (WBT), then in the event of a crisis its value might fall along with the exchange. Best practices (detailed in our reviews of Binance and Bybit) suggest storing such funds in liquid assets (BTC, ETH, stablecoins) and maintaining transparency of their state. A sum of $30 million seems modest against trillion-dollar trading volumes and may prove insufficient in a large-scale incident.

Cybersecurity: An Impregnable Fortress

If financial transparency is WhiteBIT’s weak spot, then cybersecurity is its strength.

- A history without hacks: During its existence, the exchange has never been hacked at the platform level.

- High ratings: The platform is ranked among the top 5 safest exchanges in the world according to CER.live and has an AAA rating. WhiteBIT became the first exchange in the world to receive a Cryptocurrency Security Standard (CCSS) level 3 certificate.

- Protection: 96% of assets are stored in cold wallets with multi-signature protection, making them inaccessible to online attacks. The platform uses a Web Application Firewall (WAF) to block hacker attacks in real time and regularly undergoes security audits by Hacken.

- Combating crime: WhiteBIT cooperates with law enforcement agencies. In 2024, the exchange froze more than $150 million in cryptocurrency linked to criminal activities and helped recover funds stolen in hacks of other platforms (including a case involving a co-founder of Ripple and the hack of Rain.com by the North Korean Lazarus group with FBI assistance).

- Bug Bounty: The exchange supports a Bug Bounty program with rewards up to $10,000 for identifying vulnerabilities.

Security Conclusion: WhiteBIT is a technologically reliable platform protected from external threats. However, what happens internally remains opaque. You can be sure that hackers won’t steal your money, but you cannot be sure that the exchange is managing it properly.

Trading Ecosystem Analysis – How Does WhiteBIT Help You Earn?

After assessing the risks, let’s consider the opportunities WhiteBIT provides for earning profits.

For the Active Trader: Speed, Low Fees, and a Powerful API

For scalpers, day traders, and algo traders, WhiteBIT offers institutional-level tools.

- Ultra-low fees with WBT: The base fees on spot (0.1%) and futures (0.01% maker / 0.035% taker) are competitive compared to Binance and Bybit. But the main advantage is the use of the native token WBT. Token holders can reduce the maker fee to 0% and the taker fee by up to 80%. For high-volume traders, this is a significant boost to profitability.

Table 1: Comparison of Base Fees (as of 2025)

| Exchange | Base Spot Fee (Maker/Taker) | Base Futures Fee (Maker/Taker) |

|---|---|---|

| WhiteBIT | 0.1% / 0.1% | 0.01% / 0.035% |

| Binance | 0.1% / 0.1% | ~0.018% / ~0.045% |

| Bybit | 0.1% / 0.1% | ~0.02% / ~0.055% |

- Lightning-fast API and HFT Infrastructure: The WhiteBIT trading engine handles up to 10,000 transactions per second. The exchange offers colocation services for high-frequency traders (HFT), allowing servers to be located near the exchange’s core, achieving an execution latency of only 5 milliseconds. The API is described as “lightning-fast” and is suitable for automated strategies. Trader reviews on TradingView confirm the platform’s high speed and reliability.

- Liquidity: Liquidity is concentrated in the top pairs (BTC, ETH); less popular altcoins may experience slippage.

- Tools: WhiteBIT does not offer built-in trading bots (grid, DCA) like Bitget, KuCoin or BingX, instead betting on integration with third-party services via API, such as Bitsgap and GoodCrypto. This emphasizes the focus on professionals who use external terminals.

Native Token (WBT): The Heart of the WhiteBIT Ecosystem

WhiteBIT Coin (WBT) is not just another token—it is the true engine of the WhiteBIT ecosystem, giving users real financial perks. The utility of WBT is meticulously designed: it transforms ordinary token ownership into an active tool for increasing profits.

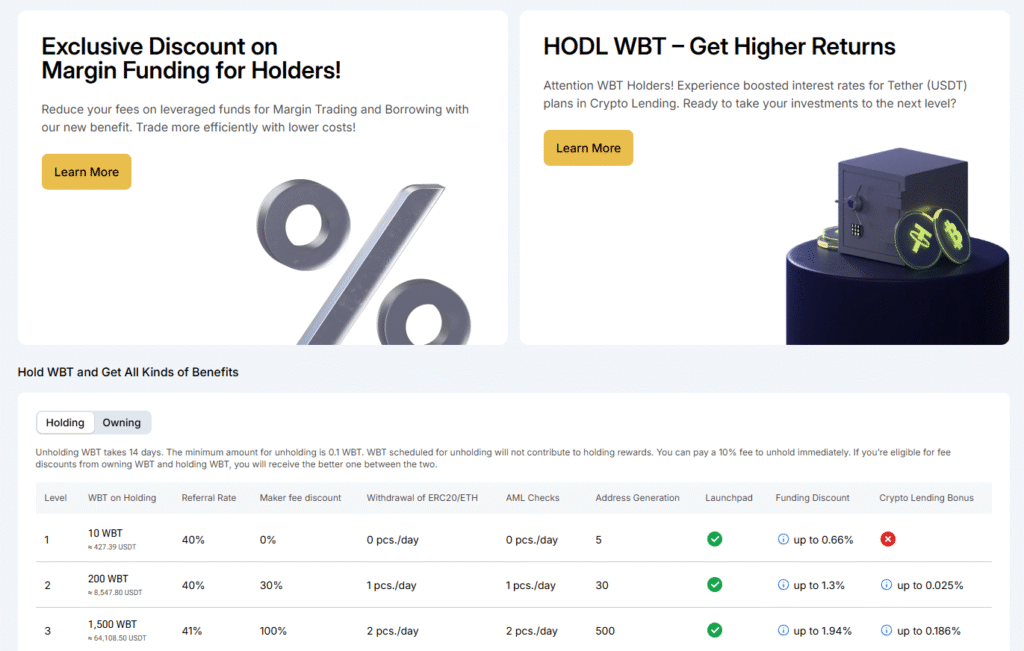

What WBT offers to its holders:

- Fees Melt Away Right Before Your Eyes: For those who trade actively, this is simply a find. WBT allows you to reduce maker fees by up to 100% (i.e., to zero) and taker fees by up to 80%. If you hold (lock) your tokens, you can completely forget about taker fees.

- Commission-Free Withdrawals: You can withdraw ETH and ERC-20 tokens for free on a daily basis. Considering the fees in the Ethereum network, this is very beneficial.

- Earn Yield Increases: WBT increases the interest rates in Crypto Lending, so you can earn even more passive income.

- More Generous Referral Program: The referral program rate can increase by up to 50%. Bring your friends and earn more!

- Free AML Checks: Check crypto addresses for links to illegal activity to ensure your transactions are safe.

Tokenomics and Scarcity

A total of 400 million WBT have been issued, and no new tokens will be created. But that’s not all: the exchange burns a portion of tokens every week, repurchasing them using 33% of trading fees and 5% from other platform revenues. Thus, the supply of WBT is constantly decreasing, which should support its value as demand grows.

Ultimately, WBT is an excellent incentive for those who want to fully immerse themselves in the WhiteBIT ecosystem. It benefits not only traders, but also long-term investors and active users who wish to reduce costs and increase earnings.

For the Investor and Passive Income Seeker: Transparent Earn and Risky Launchpad

- Crypto Lending (up to 18.64% APY): A product for passive income – “Crypto Lending.” You lend your assets to the exchange, and it uses them to provide liquidity to margin traders. The yield is generated from the interest paid by these traders. The rates reach up to 18.64% per annum, especially with long-term plans (360 days). WBT holders receive an additional bonus on the rates.

- Launchpad: The IEO platform on WhiteBIT has a questionable reputation. The only documented project, Scamfari (SCM), turned out to be a failure for investors. After the hype, the token price collapsed by more than 99.9%. This indicates the exchange team’s weak expertise in selecting projects. At the moment, WhiteBIT’s Launchpad is a “red flag,” especially when compared to leading platforms reviewed here, such as Binance and OKX.

For Everyday Use: The WhiteBIT Nova Card – A Bridge Between Crypto and Fiat

The WhiteBIT Nova debit card, issued in partnership with Visa, is a fully functional financial tool for residents of the European Economic Area (EEA).

- Direct Crypto Spending: The card allows you to pay with cryptocurrency (BTC, ETH, USDC, WBT, and others) directly from your exchange balance.

- No Maintenance Fees: There are no fees for opening, closing, or inactivity of the card.

- Up to 10% Cashback: Users can receive cashback in BTC or WBT. Categories include subscriptions (10%), taxis and pet expenses (5%), entertainment (2%), groceries and cafes (2%).

- Full Integration: The card supports Apple Pay and Google Pay.

- Convenient Management: The app allows you to top up your balance (including SEPA), set asset spending priorities, and track expenses.

The Nova card is an incentive to store and spend assets within the WhiteBIT ecosystem, turning the exchange into a crypto-bank for European users.

Final Verdict and Recommendations

SWOT Analysis for a Trader (2025)

Strengths

- Elite cybersecurity: Confirmed by audits, an AAA rating, and a history without hacks.

- WBT Tokenomics: The opportunity to trade with zero maker fees and enjoy free withdrawals.

- Institutional-grade infrastructure: A high-performance API and colocation services for HFT trading.

- Strong regulatory base in the EU: Licenses and readiness for MiCA provide legal certainty.

- Innovative ecosystem: The Nova card and non-custodial Whitewallet create a comprehensive environment.

Weaknesses

- Lack of Proof of Reserves: The inability to verify the existence of your funds is the main risk.

- Opaque insurance fund: The size and composition of the fund raise questions.

- Failed Launchpad: The catastrophic performance of the first project undermines trust in IEOs.

- Limited toolkit: The absence of native bots and advanced order types in the interface.

- Average liquidity in altcoins: The risk of slippage for large orders on non-top pairs.

Opportunities

- Become an “ecosystem trader”: Use WBT and the Nova card to minimize costs and earn cashback.

- Domination in a regulated EU: The potential to become the main platform for institutions after MiCA takes effect.

- Using the API for complex strategies: Low latency opens doors for arbitrage and scalping.

Threats

- Counterparty risk: Without PoR, users depend on the exchange’s honesty and solvency.

- Competition: Exchanges like HTX, BitMart, or MEXC offer a broader set of tools for retail traders.

- Dependence on WBT: The exchange’s economic model is strongly tied to the value of its token.

Final Recommendation and Trader Profile

WhiteBIT in 2025 is an exchange of extremes. On one hand, it is a technological leader with top-notch cybersecurity, infrastructure for professionals, and a strategy aimed at dominating Europe. Its ecosystem with the WBT token and the Nova card offers financial benefits.

On the other hand, the absence of financial transparency via Proof of Reserves is a serious risk. This makes the long-term storage of large sums on the exchange risky.

Recommended Profile

Ideal for:

- Algo traders and HFT firms: Low latency, colocation, and an API combined with zero maker fees create an almost perfect environment.

- Active European traders with high volumes: Those ready to integrate into the ecosystem (buying WBT, using the card) to reduce costs and maximize profits.

- Crypto enthusiasts in the EU: Those looking for a platform for trading, passive income, and everyday transactions via the Nova card.

Less suitable for:

- Long-term investors (“HODLers”): Storing large amounts on an exchange without PoR is an unjustified risk. It is better to use non-custodial wallets (for example, Whitewallet) or exchanges with public PoR, such as Bitfinex.

- “Gem hunters” in IEOs: The Launchpad is a source of high risk.

- Traders from the USA, the UK, and Canada: The exchange is unavailable in these jurisdictions.

List of WhiteBIT’s Unique Advantages

- WBT Tokenomics: The opportunity to reduce maker trading fees to 0% is one of the strongest proposals on the market for active traders.

- Institutional-Grade Infrastructure: Offering colocation with a 5 ms latency places WhiteBIT on par with the world’s leading HFT venues.

- WhiteBIT Nova Card: A bridge between cryptocurrency and the real world with zero service fees and up to 10% cashback, available for EU residents.

- Regulatory Focus on the EU: Licensing in key European countries ensures legal protection and prepares the exchange for future MiCA regulation.