In short: An exchange for pros, not a secure wallet for beginners.

In 2025, Gate.io is both a treasure trove of unique opportunities for traders and a minefield of risks. On one hand, you can find over 3800 crypto-assets and a plethora of interesting trading tools. It’s a real paradise for those looking for “pearls” among cryptocurrencies and who enjoy speculating.

On the other hand, there are serious problems: a non-transparent company structure that makes it difficult to understand who is responsible for what, cases of hacks, and user complaints about account freezes and poor support.

Conclusion: Gate.io is a powerful yet dangerous tool. It is only suitable for experienced traders who know how to manage risks and do not plan to store their savings here.

Company Structure: Who is Responsible for What?

How It All Started: From Bter.com to a Global Level

In 2013, Dr. Lin Han, an IT and mathematics specialist, founded the exchange Bter.com in China. According to the legend, his personal experience of losing 100 BTC due to fraud pushed him to create “secure gateways” to the world of cryptocurrencies.

In 2017, when Chinese authorities began regulating cryptocurrencies, Bter.com changed its name to Gate.io and started expanding worldwide, moving its operations out of China. Thus, the exchange transformed into a complex structure with offices in different countries.

The Cayman Islands: More Questions Than Answers

Officially, Gate.io is registered in Georgetown, Cayman Islands—a popular location for crypto funds due to its lenient regulations. But there is a nuance: The Cayman Islands Monetary Authority (CIMA) stated that Gate.io is not registered and does not have the right to operate as a provider of virtual asset services (VASP).

This means that the “headquarters” in the Cayman Islands is merely a legal shell creating an illusion of legitimacy. In reality, management of the company is divided among different subsidiaries. This allows Gate.io to minimize risks but creates problems for users who, in case of a dispute, will not be able to determine exactly with whom they are dealing.

World Domination and Obstacles Along the Way

Gate.io is actively opening branches in different countries, for example, in Japan (Gate Japan Co., Ltd.), Singapore (Gate Ventures), Hong Kong (Gate HK), and Dubai (Gate MENA DMCC).

Since 2022, the company has been trying to enter the US market. The subsidiary Gate US is registered with FinCEN and has obtained money transfer licenses in several states. But after the official launch in August 2025, the service remains very limited and unavailable to most Americans.

Overall, Gate.io reacts to changes in legislation rather than trying to negotiate in advance with regulators. This allows the company to adapt quickly, but it does not guarantee full compliance with all requirements.

Licenses: Many, but Not Everywhere

A “Patchwork Quilt” of Licenses

Gate.io obtains licenses in different countries, mainly in Europe and offshore zones. This creates an appearance of compliance, but in reality these licenses only protect users from those specific countries.

As of 2025, Gate.io holds licenses in Malta, Italy, Lithuania, Gibraltar, Dubai, Hong Kong, the Bahamas, and possibly Australia.

Where Gate.io Does Not Operate

| Jurisdiction | Regulatory authority | Gate.io legal entity | License/registration type | Status |

| Malta | (https://www.mfsa.mt/) | Gate Technology Ltd. | Class 4 VFA service provider | Active |

| Italy | OAM | Gate Italy S.R.L | VASP service provider | Active |

| Lithuania | – | Gate Global UAB | Virtual currency exchange and storage operator | Active |

| Gibraltar | https://www.fsc.gi | Hippo Capital Co. Limited | DLT technology provider | Active |

| Dubai | https://dmcc.ae/ | Gate MENA DMCC | Proprietary trading of crypto assets | Active |

| Hong Kong | Company Registry | Hippo Financial Services Limited | TCSP service provider / VASP application | Operational / In progress |

| Bahamas | https://www.scb.gov.bs/ | Gate Global Limited | Digital asset exchange | Active |

| Australia | https://www.austrac.gov.au/ | Gate Information Pty Ltd | Digital currency exchange service provider | Claimed (unconfirmed) |

| Japan | – | Gate Japan Co., Ltd. | Licensed exchange (through acquisition) | Active |

| United States | FinCEN | Gate US | Money Services Business (MSB) | Registered, service launched but limited |

| Cayman Islands | CIMA | Gate.io / Gate Global Corp | – | Officially declared unregistered |

Gate.io claims to operate in 165 countries but avoids large and strictly regulated markets such as the USA, China, the United Kingdom, Canada, France, Germany, Singapore, Malaysia, and the Netherlands. This is because the company does not meet the high AML/CFT and consumer protection standards set in these countries.

Security and Solvency

Proof of Reserves (PoR): Is Everything That Transparent?

Gate.io was one of the first to implement the Proof of Reserves (PoR) system, which allows users to verify the existence of funds on the exchange. In 2025, the system uses advanced encryption technologies that permit asset verification without disclosing personal information.

Audits are conducted by independent companies such as Armanino LLP and Hacken, which highly praised the encryption system and found no significant vulnerabilities.

Financial Stability in Numbers (2025)

According to the latest audit, in May 2025 the total value of Gate.io’s reserves was $10.865 billion, with excess reserves of $2.415 billion. This means that the exchange has enough funds to cover all obligations to its users.

Table 2: Summary of the Proof of Reserves Report (May 2025)

| Metric | Value/Ratio |

| Total Reserve Value | $10.865 billion |

| Excess Reserve Value | $2.415 billion |

| Total Reserve Ratio | 128.57% |

| BTC Reserve Ratio | 137.69% |

| ETH Reserve Ratio | 121.36% |

| USDT Reserve Ratio | 102.63% |

Hack History: Past Mistakes

In 2018, the exchange lost about $234 million due to a hack. It is believed that this occurred because of the reuse of compromised wallets after the Bter.com hack in 2015.

After this, Gate.io strengthened its security measures, obtained ISO 27001 certification, and implemented new protection technologies. In 2024, there were rumors of a new hack, but these were not confirmed.

The modern PoR system protects against misappropriation of funds but not against external attacks. The risk of insolvency is low, but the threat of cyber attacks remains relevant.

Gate.io is a veteran with a long history. But in crypto, age does not always equal security. How does this apply to the younger but major player OKX? Let’s take a look at the competition: OKX in 2025: Regulatory giant or dark horse? A complete analysis

Insurance Fund: Protection Against Losses

Gate.io has an insurance fund to compensate users for losses. However, the size of the fund is not disclosed, which undermines confidence in this protection system.

Trading Platform: Opportunities and Risks

Huge Asset Selection: Is It Good or Bad?

Gate.io offers more than 3800 cryptocurrencies and over 2900 trading pairs. This attracts traders looking for rare altcoins and new projects.

However, there is a downside: many tokens have low liquidity, leading to high spreads and volatility. The responsibility for assessing these risks lies with the trader. Gate.io is geared towards the speculative segment of the market, increasing the risk of encountering illiquid or fraudulent projects.

Spot and Derivatives Trading

The platform offers standard spot trading, margin trading with up to 10x leverage, and derivatives with up to 100x leverage.

Automated Trading and Copy Trading

Gate.io provides free trading bots and a copy trading service, allowing users to replicate the trades of successful traders. However, the system for selecting “top traders” is not transparent, which creates additional risks.

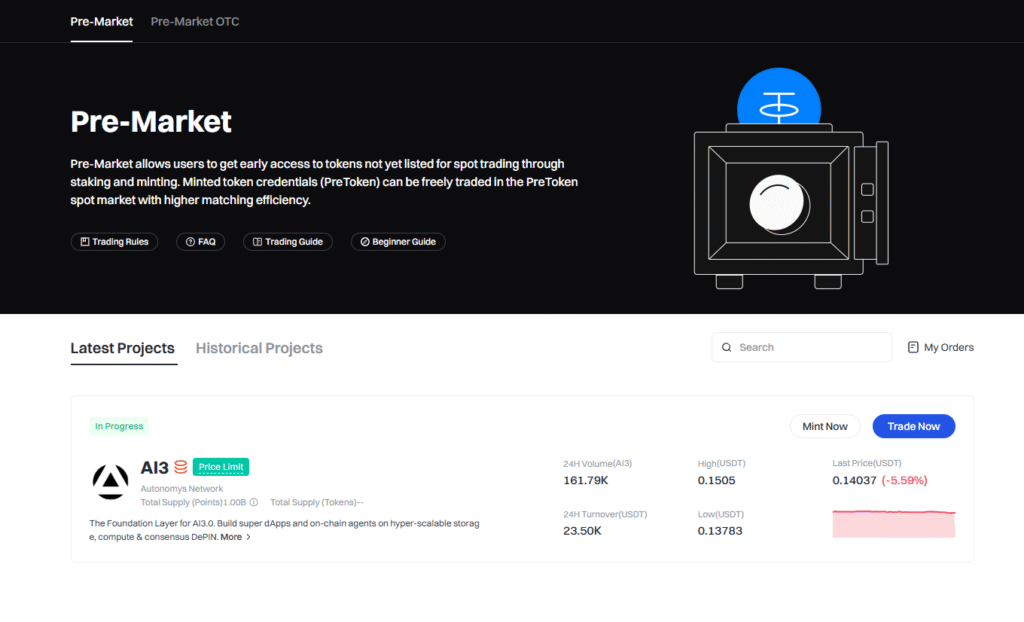

Early Access Platforms: Startup and Pre-Market

Gate.io Startup (IEO) is a platform for initial exchange offerings, where over 1000 projects were presented. The average historical ROI at the price peak is 12.58x.

Pre-Market Trading is a unique feature that allows trading tokens before their official listing. It is a very risky product where buyers and sellers agree on a price for future delivery.

Passive Income (“Earn”)

Gate.io offers staking, crypto lending, and periodic investment plans with high but non-guaranteed rates.

Fees: Beneficial for Big Players

Trading Fees: Expensive for Beginners, Beneficial for Pros

The standard fee (VIP 0) is 0.2% for both maker and taker. This is higher than competitors. Fees only become competitive at high VIP levels.

Futures Trading: The base rate for perpetual contracts is 0.020% for makers and 0.050% for takers.

Discounts: Users can receive a discount of up to 25-30% by paying fees with the GateToken (GT) or using “Point Cards.”

Deposit and Withdrawal Fees

Deposits: Cryptocurrency deposits are free.

Conclusions: Withdrawal fees are dynamic and depend on the asset and network. They can be high, which is a frequent complaint from users.

USDT (TRC20): $2.00

USDT (ERC20): $1.00

ETH (Ethereum Network): ~$0.94 (0.000216 ETH)

Table 3: Comparative Fee Analysis (Standard Level, 2025)

| Exchange | Spot (Maker) | Spot (Taker) | Futures (Maker) | Futures (Taker) | Notes |

| Gate.io | 0.20% | 0.20% | 0.020% | 0.050% | Discounts when paying in GT. |

| Binance | 0.10% | 0.10% | 0.018% | 0.045% | Discounts for payments in BNB. |

| KuCoin | 0.10% | 0.10% | 0.020% | 0.060% | 20% discount when paying in KCS. |

| Bybit | 0.10% | 0.10% | 0.020% | 0.055% | VIP levels reduce fees. |

| Kraken | 0.25% | 0.40% | 0.020% | 0.050% | Fees for Kraken Pro. |

| Coinbase | 0.40% | 0.60% | 0.020% | 0.040% | Fees for Coinbase Advanced. |

| MEXC | 0.00% | 0.05% | 0.01% | 0.04% | Spot fees may be 0.1% depending on the pair. |

| BingX | 0.10% | 0.10% | 0.020% | 0.050% | For standard futures, the commission is 0.045%. |

| Bitget | 0.10% | 0.10% | 0.020% | 0.060% | 20% discount when paying in BGB. |

| OKX | 0.08% | 0.10% | 0.020% | 0.050% | Discounts available with OKB tokens. |

| FreeDX | 0.15% | 0.2% | 0.02% | 0.07% | VIP levels reduce fees. |

GateToken (GT) Ecosystem

Why is GT Needed?

GateToken (GT) is the token of the exchange and its blockchain, GateChain. It offers fee discounts, allows upgrading of VIP levels, grants access to IEOs, and enables participation in governance.

The token has a deflationary model: Gate.io uses 15% of its revenue to buy back and burn tokens. The value of GT depends on the exchange’s success.

GateChain Blockchain

GateChain is its own blockchain, compatible with EVM and operating on a Proof-of-Stake (PoS) mechanism.

Platform Performance and User Feedback

API Stability: Promises vs. Reality?

Gate.io claims that its API is easy to use and highly liquid. However, trader reviews say otherwise: users complain about prolonged downtimes, issues with order execution, and rate limit restrictions.

Customer Support: The Weak Link

The platform’s interface is described as cluttered and non-intuitive. But the main problem is the customer support, which receives numerous complaints. Users report long response times, ticket closures without problem resolution, and asset freezes without explanation.

Conclusions and Recommendations

SWOT Analysis for Traders (2025)

Strengths:

- A huge selection of cryptocurrencies.

- Powerful trading tools.

- A transparent Proof of Reserves system.

- The utility of the GT token.

Weaknesses:

- Regulatory uncertainty.

- A history of hacks.

- Poor customer support.

- High fees for beginners.

Opportunities:

- Become the leading platform for speculative traders.

- Obtain licenses in major countries.

- Develop the GateChain ecosystem.

Threats:

- Tightening regulations.

- Competition from other exchanges.

- New hacks.

- Poor service.

Who is Gate.io Suitable For?

Gate.io is a platform with high risk and high potential returns.

- Beginners and long-term investors: strongly not recommended.

- Experienced speculators: may use it, but with caution. It is recommended to use the platform only for accessing unique assets and not to store funds here.

- Algorithmic traders: use with caution due to API instability.