In 2025, BingX is no longer just a crypto exchange, but a complete ecosystem for those seeking opportunities to earn from cryptocurrency. But is it worth trusting with your money? This article is your guide to the world of BingX, which will help you make a well-considered decision.

BingX is a story of ups and downs. In September 2024, the platform suffered a major hack that could have sunk any other company. But BingX not only stood its ground, it also learned lessons from the situation. In 2025, the exchange can boast of:

- Fully compensating losses to affected users.

- Implementing advanced security measures, including the Shield Fund insurance pool in the amount of over 179 million dollars.

- Cryptographically verified Proof of Reserves.

- PCI DSS data security standard certification, obtained in August 2025.

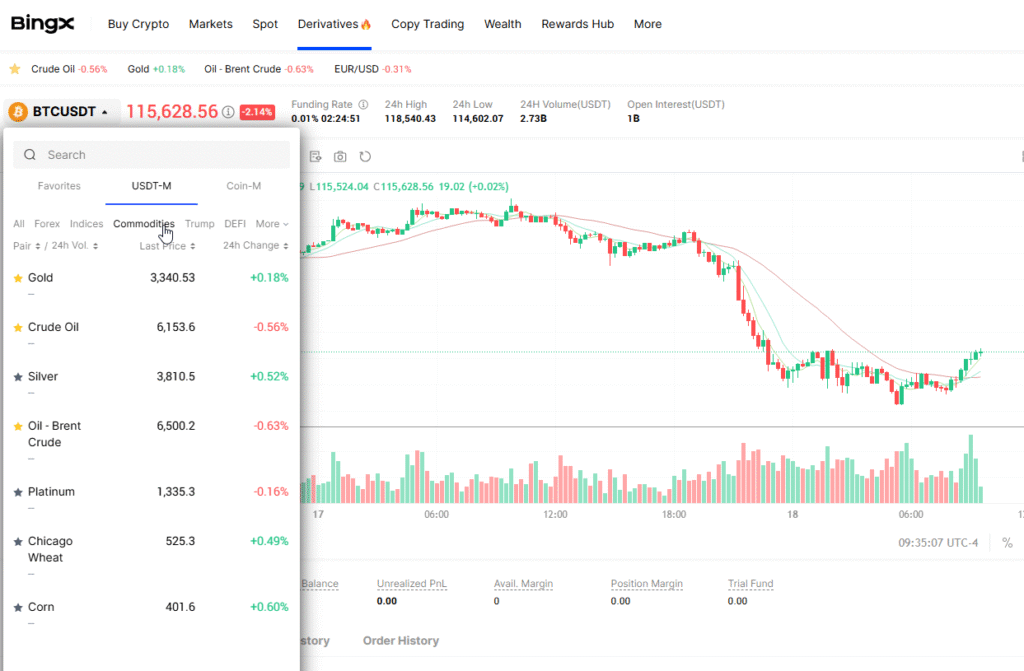

The BingX trading ecosystem is geared toward traders seeking “alpha”. The platform’s strength lies in derivatives. Low fees, leverage up to 150x, and the ability to trade traditional assets (Forex, indices) using cryptocurrency as collateral make it attractive to many. Additionally, there is a developed copy-trading platform and AI-based tools launched in May 2025.

But there are also downsides. BingX adheres to a “regulatory arbitrage” strategy, obtaining licenses in countries with lenient regulation, while restricting access for users from the USA, the UK, and Canada. In addition, professional algo-traders will face a limitation: the API does not provide access to standard stock and Forex futures.

Conclusion? In 2025, BingX is a powerful tool for derivatives traders and copy-traders living outside countries with strict regulation. It is a choice for those who value innovation and are ready to accept regulatory uncertainty in exchange for unique trading opportunities.

Who is behind BingX?

To understand whether the exchange can be trusted, one must know who runs it. Let’s examine the corporate structure of BingX, its management, and its relationships with regulators.

The Mystery of the Leadership

BingX was founded in 2018 and by 2025 serves over 10 million users in 150 countries. But information about its founders is quite vague. In some sources, Josh Lu is mentioned as a co-founder, while in others – someone named “Li”. Such opacity raises questions.

However, the appointment of Daniel Lai as Director of Business Development in May 2025 indicates that the company is striving for greater transparency and professionalism. His tasks include risk management, strengthening the regulatory framework, and developing security partnerships.

Playing with Regulators

BingX has offices in the EU, Australia, Hong Kong, and Taiwan. The company obtains licenses where it is easier in order to offer services globally. At the moment, BingX holds licenses in Australia (digital currency exchange, AUSTRAC supervision) and Lithuania (digital currency exchange, FSIC license).

The situation in North America is more complicated. BingX claims to be registered with FinCEN (USA) as a money services business (MSB), but an independent audit does not confirm this. This is a significant discrepancy.

This approach is “regulatory arbitrage”. It allows for rapid growth but carries risks, as regulators around the world are tightening the rules.

Table 1: BingX Regulatory Status in 2025

| Jurisdiction | Regulatory Authority | Type of License/Registration | Status |

|---|---|---|---|

| Australia | AUSTRAC | Digital Currency Exchange (DCE) | Active |

| Lithuania | FSIC | Digital Currency Exchange | Active |

| USA | FinCEN | Money Services Business (MSB) | Claimed by BingX, but not confirmed by an independent audit |

Important: BingX blocks access for users from the USA, China, Hong Kong, Singapore, Canada, the Netherlands, and the UK.

KYC and AML: A Filter for Users

BingX requires mandatory KYC (Know Your Customer) verification from all users to combat money laundering (AML). The platform collects identity documents, address verification, and information on the source of funds.

There are different levels of verification. “Advanced KYC” allows withdrawals of up to 5,000,000 USDT per day and opens up access to P2P trading. Even for unverified accounts, there is a withdrawal limit of 50,000 US dollars per day. Such a high limit may attract attention from regulators in the future.

BingX Security: A Fortress or a House of Cards?

After the 2024 hack, security became a matter of survival for BingX. Let’s see what lessons the exchange has learned.

Reserve Transparency

BingX guarantees 100% Proof of Reserves (PoR), meaning that every dollar of a user’s funds is backed by real assets. An independent firm, Mazars, conducts the audit.

BingX regularly publishes Merkle tree data, allowing users to cryptographically verify that their funds are included in the audit. As of July 2025, reserve ratios exceed 100%: 132.63% for BTC, 140.58% for ETH, and 146.54% for USDT.

Shield Fund: 179 Million Dollars in Insurance

In June 2025, BingX launched the Shield Fund – an insurance pool to protect users from losses resulting from cyberattacks or technical failures. Initially, its size was 150 million dollars, but by August 2025 it had grown to 179.24 million dollars.

Audits, Bug Bounty, and PCI DSS Certification

BingX collaborates with the audit firm SlowMist and supports a Bug Bounty program, rewarding researchers for discovering security flaws.

In August 2025, BingX received the PCI DSS v4.0.1 certificate. This is the payment card industry data security standard, which confirms the exchange’s adherence to strict security requirements, especially in the protection of fiat payments.

The 2024 Hack: How It Happened and What Changed

The hack in September 2024 was a moment of truth for BingX.

Chronicle of the Attack

The attack took place on September 19-20, 2024, and was targeted at hot wallets. The hackers used a complex multi-chain strategy to siphon funds via the Ethereum, BNB Chain, and Polygon networks.

Financial Consequences

The total losses ranged from 44.7 to 52 million dollars. BingX stated that this was only a small part of its overall assets, as the majority of funds were stored in cold wallets.

BingX immediately activated its emergency protocol and suspended withdrawals. Product Director Vivien Lin stated that BingX would fully compensate the losses from its own capital.

Conclusions

The hack exposed vulnerabilities in the protection of hot wallets. However, subsequent actions – launching the Shield Fund, obtaining the PCI DSS certificate, and ongoing Proof of Reserves audits – show that the exchange learned its lessons.

This incident demonstrated historical vulnerability, yet at the same time showcased the financial strength and resilience of the platform.

What Does BingX Offer Traders?

Let’s examine the markets, fees, and liquidity that BingX offers.

Spot and Derivatives

BingX offers more than 700 cryptocurrencies for spot trading.

The main feature of BingX is its derivatives platform with perpetual futures and leverage up to 150x. Here you can trade currency pairs (Forex), stock indices, and commodities using cryptocurrency as collateral.

Fees

BingX fees are tailored for derivatives traders.

- Spot trading: 0.1% for makers and takers.

- Perpetual futures: 0.02% for makers and 0.05% for takers.

- Standard futures: 0.0450%.

- Deposits: Free.

- Withdrawals: Depends on the network.

BingX does not have its own token, so there are no fee discounts for holding one.

Table 2: Comparison of Trading Fees (Basic Level)

| Trading Type | BingX | Binance | Bybit | OKX |

|---|---|---|---|---|

| Spot (Maker/Taker) | 0.1% / 0.1% | 0.1% / 0.1% | 0.1% / 0.1% | 0.08% / 0.1% |

| Perpetual Futures (Maker/Taker) | 0.02% / 0.05% | 0.02% / 0.05% | 0.02% / 0.055% | 0.02% / 0.05% |

Liquidity

Liquidity on BingX falls short of the industry leaders. For traders with large volumes, this could result in slippage.

BingX offers a “Guaranteed Stop-Loss” feature, which promises order execution at the specified price or better, and claims “zero slippage” on futures.

Unique Features of BingX

What makes BingX special? Copy trading and AI-based tools.

Copy Trading

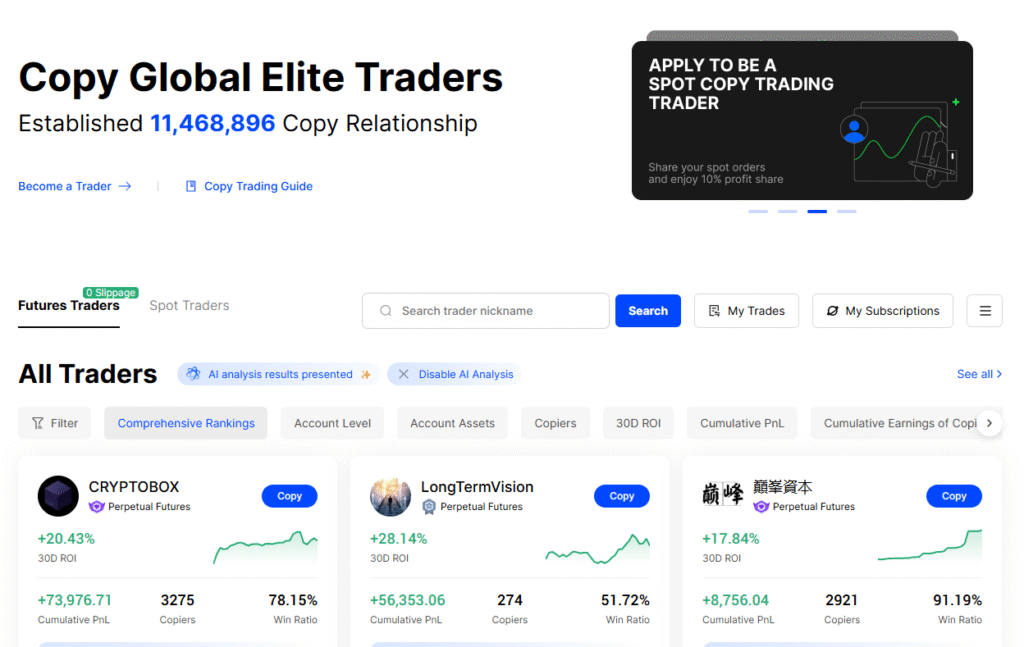

Copy trading is the hallmark of BingX. The platform has created an ecosystem of over 8,000 elite traders and 7 million followers.

The platform provides detailed statistics for each master trader: ROI, PnL, percentage of profitable trades, and risk rating. Traders receive a share of their followers’ profits (up to 20%).

Bingx AI: The AI Assistant

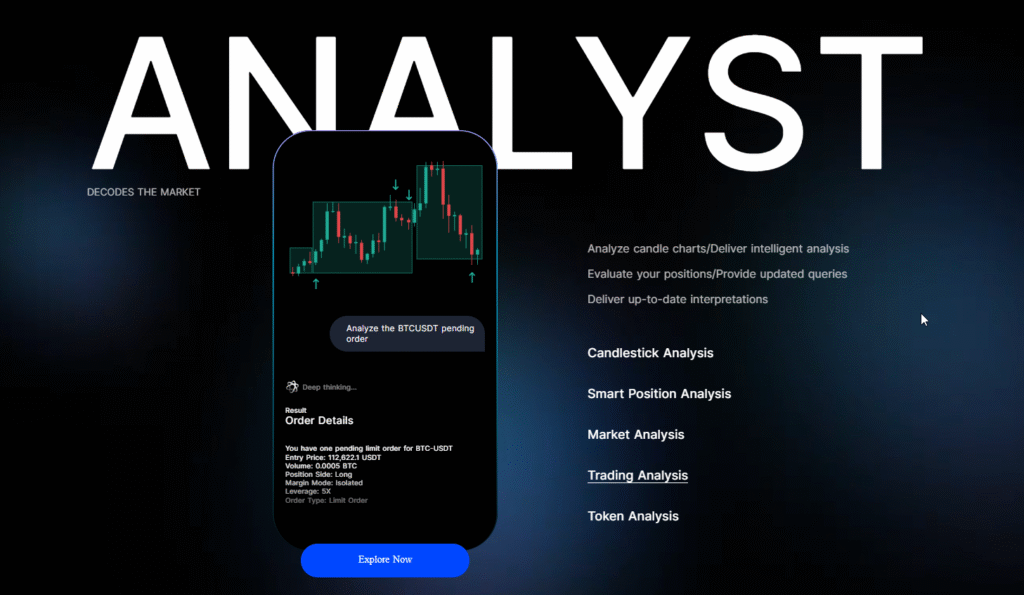

In 2025, BingX introduced Bingx AI – an integrated AI assistant. The “Trade Review” feature analyzes your trading history, identifies mistakes, and offers recommendations for improvement.

Additionally, the platform offers grid bots (Grid Trading) which can be configured both automatically and manually.

API for Algo-Traders

BingX offers an API for algorithmic trading. However, API access to standard futures (stocks, Forex, indices) is closed. You can automate trading on the spot market and on the perpetual futures market, but BingX’s most unique assets remain inaccessible to bots.

Passive Income

BingX offers products for passive income “BingX Earn”, including staking and structured products.

BingX does not have its own native token. This is most likely to avoid attracting unnecessary attention from regulators.

BingX: Is It Right for You?

Let’s determine for whom BingX will be the ideal choice in 2025.

- Beginner: An excellent choice. The intuitive interface, demo account, and copy trading create the perfect environment to get started.

- Day Trader: A good choice. Competitive fees on futures, high leverage, and advanced order types are suitable for active trading. But keep in mind the potentially lower liquidity.

- Derivatives Specialist: An ideal choice. Low fees, high leverage, and the ability to trade TradFi assets with crypto collateral make the platform a powerful tool.

- Copy-Trader: Best in class. BingX is the leader in this niche.

- Algo-Trader: Conditionally suitable. The lack of API access to standard futures is a critical drawback.

Table 3: BingX Suitability Matrix for Different Types of Traders

| Trader Profile | Interface Usability | Futures Fees | Leverage | Liquidity | Copy Trading | Built-in Bots and AI | API Access |

|---|---|---|---|---|---|---|---|

| Beginner | Excellent | Excellent | Excellent | Good | Excellent | Excellent | Not applicable |

| Day Trader | Good | Excellent | Excellent | Average | Good | Good | Poor |

| Derivatives Specialist | Good | Excellent | Excellent | Average | Good | Good | Poor |

| Copy-Trader | Excellent | Excellent | Excellent | Good | Excellent | Good | Not applicable |

| Algo-Trader | Not applicable | Excellent | Excellent | Average | Not applicable | Poor | Poor (no standard futures) |

BingX Risks and Opportunities in 2025

SWOT Analysis

Strengths:

- The best copy-trading platform in the market.

- Low fees for derivatives trading.

- Unique access to TradFi markets with crypto-margin.

- Reliable and verifiable security measures (PoR, Shield Fund, PCI DSS).

- Innovative AI-based tools.

Weaknesses:

- The hack in September 2024.

- Ambiguous regulatory status.

- Liquidity lower than that of market leaders.

- Limited API access to standard futures.

Opportunities:

- Become a leader in the hybrid trading niche (crypto + TradFi).

- Attract a new generation of traders with AI and social features.

- Establish a dominant position in emerging markets.

Threats:

- Tightening of crypto regulations.

- The emergence of new competitors in the social trading niche.

- Recurrent security incidents.

Final Recommendations

In 2025, BingX is a phoenix exchange that rose from the ashes of a hack. Its unique combination of social trading, derivatives trading, and AI tools makes it attractive to a certain type of trader.

Who we recommend BingX to:

Retail and semi-professional traders from countries outside the USA and UK who specialize in derivatives, copy trading, and are looking for innovative tools.

Who should be cautious:

Traders dealing with large volumes, institutional clients, and algo-traders who require full API access to all markets.

A word of advice for everyone:

Regularly use the Merkle tree verification feature on the BingX website to ensure your assets are safe.