What You Need to Know About Binance Today (in Brief)

Are you wondering if you should entrust your assets to Binance in 2025? In general, yes, but there are nuances. This article is a detailed analysis of Binance, the crypto market leader by trading volume and number of users (over 285 million!). We review everything: from changes in leadership and regulatory shifts to trading tools and security measures. Dive into the crypto empire that is currently undergoing a transformation.

From the “Wild West” to Wall Street

The main point: Binance is no longer that startup that ignored the rules. CZ’s departure and the appointment of Richard Teng (former regulator) mark a change in course. Binance is transforming into a financial institution aiming to work with regulators. The success of this transformation will determine whether the exchange retains its leadership in a new, more stringent digital finance environment.

Conclusions for the Trader:

- Scale: Binance is a vast world with over 500 cryptocurrencies, high liquidity, and an enormous user base.

- Regulation: Binance pays fines and faces bans, but is actively obtaining licenses worldwide, striving to improve its reputation.

- Security: Despite past hacks, Binance takes security seriously. The reserve proof system and the SAFU insurance fund of 1 billion USDC are tools to protect your funds.

- Ecosystem: BNB and BNB Chain create a network effect, lower fees, and provide access to exclusive opportunities.

What’s Next?

It is expected that Binance’s growth will slow, and the company will be more cautious, sacrificing some aggressiveness for licenses. For you, this means more stability, but possibly fewer highly profitable opportunities. Binance’s main goal now is to attract institutional money, and for that, an impeccable reputation is needed.

Leadership Change: How CZ’s Departure and Teng’s Arrival Are Changing the Game

“Without a Headquarters”: Genius or a Ticking Time Bomb?

CZ prided himself on Binance not having a headquarters, comparing it to the decentralized Bitcoin. This allowed the exchange to navigate between jurisdictions and avoid regulators. But this strategy led to accusations of evading oversight, multi-billion dollar fines, and bans.

CZ’s Legacy: Growth and Risky Moves

CZ launched the exchange in 2017, and it quickly became a leader. His philosophy of “move fast and break stereotypes” and the launch of BNB laid the foundation for success. But this aggression led to conflicts with regulators, a court case, a $50 million fine, and imprisonment. Binance paid a record $4.3 billion. CZ built an empire but left behind regulatory problems.

New CEO: Richard Teng

The appointment of Richard Teng as CEO in November 2023 is an important signal. Teng is a financier and former regulator. Binance wants to become a law-abiding financial institution. Teng’s experience in establishing rules for fintech makes him an ideal negotiator with authorities. His task is to create a compliance system, restore trust, and attract institutional investors.

CZ’s strategy, effective in the early crypto market, became toxic. To survive, Binance had to sacrifice its founder and appoint a person who speaks the same language as regulators. This marks the beginning of crypto giants integrating into the global financial system.

Binance’s Licensing Map and Regulatory Battles

Global Expansion by the Rules

In 2025, Binance is actively obtaining licenses worldwide. Let’s review where the exchange has established itself:

Table 1: Global Regulatory Status of Binance (2025)

| Region | Country | Regulatory Authority | Type of License/Registration |

|---|---|---|---|

| Europe | France | Autorité des Marchés Financiers (AMF) | Digital Asset Service Provider (DASP) |

| Italy | Organismo Agenti e Mediatori (OAM) | Digital Asset Service Provider (DASP) | |

| Lithuania | Registry of Legal Entities / FIU | Virtual Asset Service Provider (VASP) | |

| Spain | Bank of Spain | Virtual Asset Service Provider (VASP) | |

| Poland | Polish Tax Administration Chamber | Virtual Asset Service Provider (VASP) | |

| Sweden | Swedish Financial Supervisory Authority | Financial Institution | |

| CIS | Kazakhstan | Astana Financial Services Authority (AFSA) | Digital Asset Trading Facility Operator |

| Middle East | UAE (Abu Dhabi) | Financial Services Regulatory Authority (FSRA) | Financial Services Permission (FSP) |

| Bahrain | Central Bank of Bahrain | Category 4 Crypto-Asset Service Provider (CASP) | |

| UAE (Dubai) | Virtual Asset Regulatory Authority (VARA) | Virtual Asset Service Provider (VASP) | |

| Asia | Australia | AUSTRAC | Digital Currency Exchange (DCE) |

| India | Financial Intelligence Unit – India (FIU-IND) | Reporting Entity | |

| Japan | Japan Financial Services Agency (JFSA) | Crypto Asset Exchange Service Provider | |

| Indonesia | Bappebti | Physical Crypto Asset Trader (PFAK) | |

| America | El Salvador | Comisión Nacional De Activos Digitales (CNAD) | DASP & Bitcoin Services Provider (BSP) |

| Argentina | Comision Nacional de Valores (CNV) | Virtual Asset Service Provider (VASP) |

Data Source: Official Binance website, 2025.

Scars of the Past

This list of licenses is the result of painful lessons and fines. Binance has faced bans and investigations in Europe, was forced to exit Canada, received fines in North America, and lost its derivatives license in Australia.

After paying billions in fines, Binance is under close scrutiny from regulators. Investors looking for a platform with a more proactive approach to obtaining licenses in strict jurisdictions should consider alternative options. In our review, we took a detailed look at how OKX is building its “European foothold” in Malta.

A New Course Toward Legitimacy

Binance has shifted from defense to offense, aiming to comply with the laws of every country. For the trader, this means more security and legal certainty, but also stricter KYC/AML procedures and possible limitations. Binance is betting on reliability for major investors.

Trading Platform: Why the Whole World Trades Here

Scale

Over 285 million users from 180+ countries and more than 500 cryptocurrencies.

Trader Tools

- Spot Trading: A simple interface with analysis tools.

- Margin and Futures Trading: Binance Futures – a platform for derivative traders with leverage up to 125x.

- API for Algo Traders: A fast and reliable API for automated strategies.

Liquidity and Slippage

High liquidity allows large trades to be executed without significantly affecting the price, minimizing transaction costs. Binance’s deep liquidity helps mitigate slippage, but even this giant can face difficulties during market panics.

Fee Analysis

- Base Rates: The standard spot fee is 0.1%.

- BNB: Paying fees in BNB gives a 25% discount (effective rate 0.075%).

- VIP Program: Discounts for traders with high volumes.

Table 2: Fee Comparison: Binance vs. Competitors (2025)

| Exchange | Maker Fee | Taker Fee | Key Features |

|---|---|---|---|

| Binance | 0.10% | 0.10% | 25% discount when paid in BNB (effective rate 0.075%) |

| Kraken Pro | 0.16% | 0.26% | Decreases with increased trading volume |

| Coinbase Advanced | 0.40% | 0.60% | Significantly higher for small volumes |

| Coinbase One | 0% (up to $10,000/month) | 0% (up to $10,000/month) | Requires a $29.99/month subscription |

For the active trader, Binance often turns out to be the most cost-effective choice.

Buying cryptocurrency on Binance via P2P or bank card is convenient, but not always profitable. If you are looking for a more flexible option with support for different currencies and low fees, check out the Volet wallet (formerly known as AdvCash). Now I will tell you how to use it.

Binance Fortress: How the Exchange Protects Your Assets

Lessons from the Past

The 2019 hack and the 2022 BNB Chain exploit made Binance stronger. The company compensated users for their losses and responded promptly to incidents.

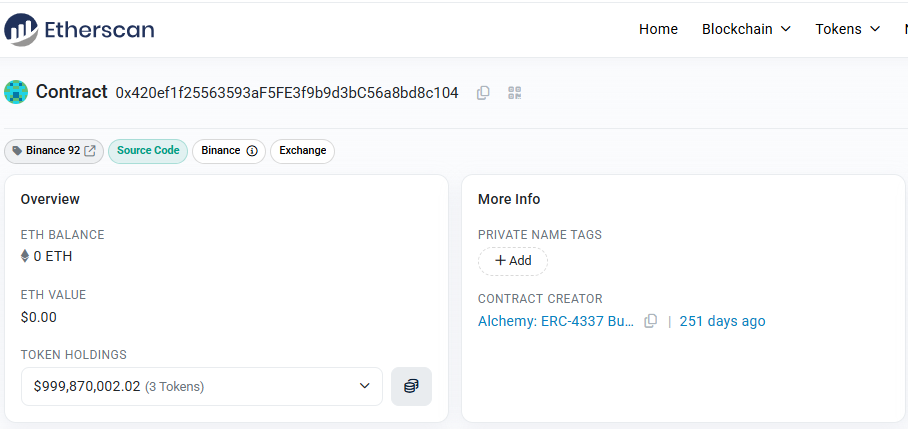

SAFU Fund

In 2024, the fund’s assets were converted into 1 billion USDC, ensuring stability and transparency. SAFU wallet address: 0x420ef1f25563593aF5FE3f9b9d3bC56a8bd8c104

Proof of Reserves (PoR)

Binance has implemented a PoR system – a cryptographic proof that assets are backed on a 1:1 basis. You can verify your balance without seeing other users’ balances. zk-SNARKs technology is used to confirm the total amount of liabilities.

Bug Bounty Program

Binance pays “white hat” hackers for discovering vulnerabilities (up to $100,000).

The BNB Ecosystem: More Than Just an “Exchange Token”

BNB Tokenomics

- Fee Discounts: 25% discount on spot trading fees.

- Blockchain Fuel: BNB is the native token of BNB Chain.

- Launchpad: Participation in exclusive new token sales.

- DeFi: Staking, liquidity farming, and collateral in lending protocols.

Burn Mechanism

Automatic burning reduces the total supply of BNB to 100 million tokens.

BNB Chain

BNB Chain is a fast and inexpensive blockchain for DeFi applications. However, it is more centralized compared to Ethereum.

More Than Trading: How to Make Your Crypto Assets Work for You

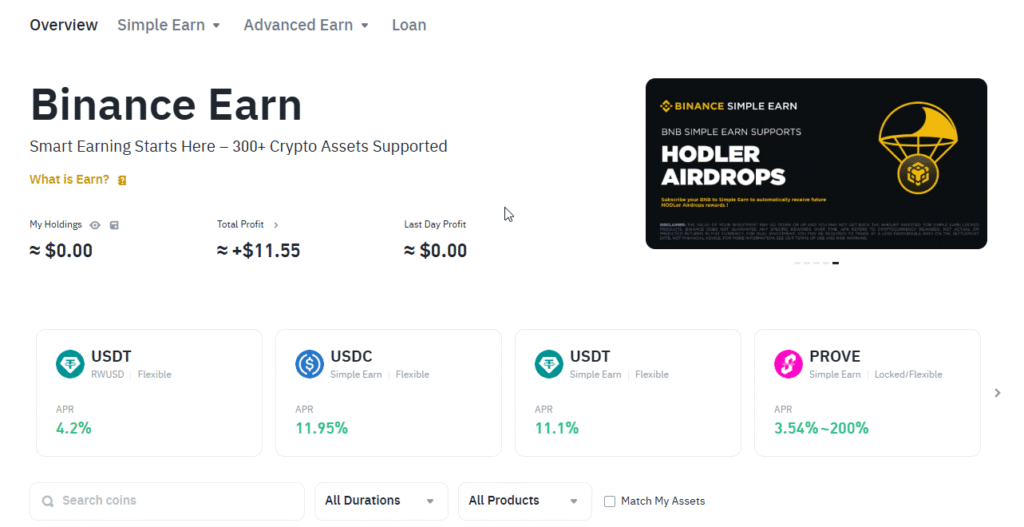

Binance Earn

Tools for earning passive income:

- Simple Earn: Flexible and fixed savings.

- Staking: Participation in securing blockchains.

- Liquidity Farming: Providing liquidity to pools.

Launchpad and Launchpool

Platforms for participating in new projects at an early stage. Launchpad – IEO, Launchpool – token farming.

Pre-Market

Trading tokens before the official listing. High risk, extreme volatility.

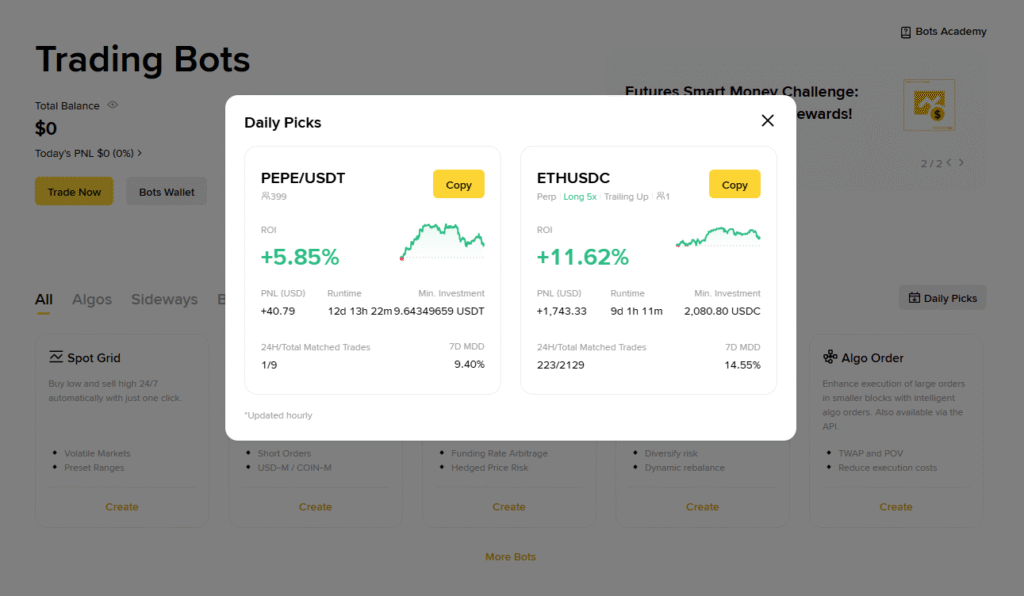

Binance Trading Bots: Automate Your Profits

Spot Grid Bot

An automated “buy low, sell high” strategy within a set price range. Suitable for a sideways market.

Spot DCA Bot

Automates the averaging down strategy (buying or selling) with flexible settings.

Despite the fact that Binance has many different products, a clear favorite has emerged in the field of social trading, making it its main feature. If you need a large and cool platform for copying trades, our review of the Bitget exchange will show you why it is called the “king of copy trading.”

The Battlefield: How Does Binance Compare to Competitors?

Price War

Binance offers the best fees, especially considering the discount when paying in BNB.

Table 3: Comparative Fee Analysis (Binance vs. Competitors, 2025)

| 30-Day Trading Volume (USD) | Binance (Maker/Taker, %) | Binance with BNB (Maker/Taker, %) | Kraken Pro (Maker/Taker, %) | Coinbase Advanced (Maker/Taker, %) |

|---|---|---|---|---|

| < $10,000 | 0.10 / 0.10 | 0.075 / 0.075 | 0.16 / 0.26 | 0.40 / 0.60 |

| $50,000 – $100,000 | 0.09 / 0.10 | 0.0675 / 0.075 | 0.12 / 0.22 | 0.15 / 0.25 |

| $1,000,000 – $20,000,000 | 0.07 / 0.10 – 0.05 / 0.07 | 0.0525 / 0.075 – 0.0375 / 0.05 | 0.06 / 0.16 – 0.02 / 0.12 | 0.05 / 0.15 |

| > $100,000,000 | 0.01 / 0.03 – 0.00 / 0.01 | 0.0075 / 0.0225 – 0.00 / 0.0075 | 0.00 / 0.10 – 0.00 / 0.08 | 0.00 / 0.05 |

Sources: Official websites of Binance, Kraken, Coinbase, 2025.

Product Battle

Binance offers more tools: over 500 cryptocurrencies, high-leverage futures, Earn platform, Launchpad, built-in bots.

SWOT Analysis

- Strengths: Liquidity, low fees, vast ecosystem, strong brand.

- Weaknesses: Regulatory issues, reputation after CZ’s departure, centralization of BNB Chain.

- Opportunities: Legitimation of the exchange, attracting institutional investors, development of Web3 innovations.

- Threats: New regulatory crackdowns, competition from DEX, security incidents.

Final Verdict and Forecast

Binance in 2025 is an aircraft carrier being retooled to meet global standards. The main priority is compliance.

What Does This Mean for You?

Binance will continue its “cleansing” by tightening KYC checks. The influx of new users may slow down, but the quality of the audience will improve. The BNB ecosystem will remain the heart of the empire, but it will be demanded to be more decentralized.

Recommendations for Different Types of Traders:

- Active retail traders: Binance is the best platform in terms of functionality and cost.

- Institutional investors: Binance is becoming a more acceptable option, but legal due diligence is necessary.

- Developers and Web3 enthusiasts: BNB Chain offers a huge audience and low costs.