Cryptocurrencies are not standing still. Every day new platforms appear, promising traders mountains of gold. Freedx – one of such exchanges that made a name for itself by raising $50 million in investments and assembling a team of veterans from Binance, Deutsche Bank, and eToro. Their goal is to create the perfect platform for traders by combining functionality with a simple interface.

But after the collapse of FTX, one announcement is not enough. What does Freedx really represent? Breakthrough technology or a high-risk project? Let’s find out.

Regulatory Puzzle: El Salvador, Panama, and Dubai

The first thing a trader looks at is the jurisdiction. And Freedx has an interesting story here.

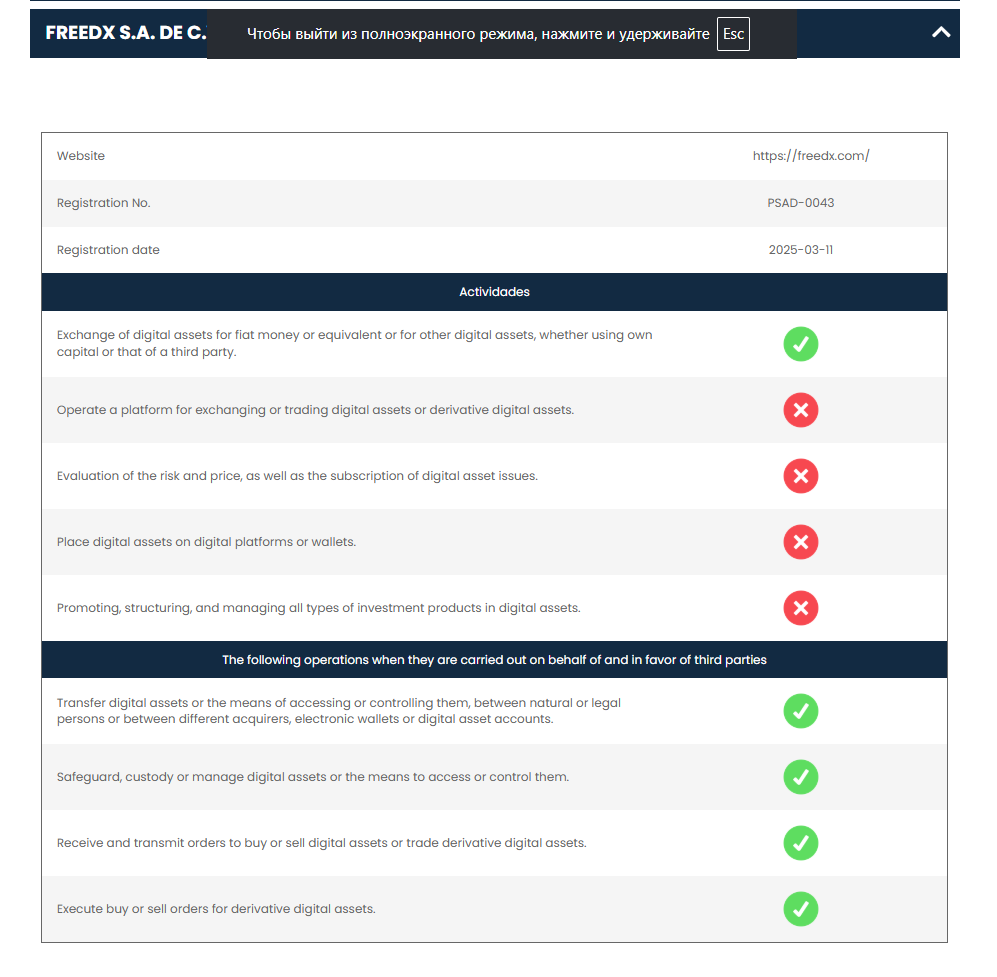

A license in El Salvador is a plus. Freedx received the Digital Assets Service Provider (DASP) license from the National Digital Assets Commission (CNAD) in El Salvador. FREEDX S.A. DE C.V. is registered under number PSAD-0043 as of March 11, 2025. El Salvador is the first country to recognize Bitcoin as legal tender, and obtaining the license here is a step towards legitimacy.

But there are nuances. Freedx mentions “permissions” in Panama and an operational headquarters in Dubai. And here the picture is more complicated.

Panama is known for its flexible approach to regulation. Obtaining the status of a “Specialized Financial Institution” (SFI) here is relatively simple and does not require stringent oversight as in major financial centers. Such jurisdictions are often used for derivatives operations.

The operational center of the company is located in Dubai. However, Freedx acknowledges that it is still in the process of obtaining a license in the UAE and does not have one yet.

This structure, where a license from one country (El Salvador) is used for marketing while operations are conducted through jurisdictions with minimal oversight (Panama), is known as a “regulatory façade”. In the event of a dispute, user rights may be protected under Panamanian law, where investor protection is minimal.

Team: Experience and Red Flags

At the helm of Freedx is Jonathan Farnell — a person with experience at eToro and Binance. His background in compliance should inspire confidence.

However, there is an episode in his career. Farnell was the CEO of Eqonex, which in 2022 received a $36 million loan from Binance, but the deal fell through and Eqonex went into liquidation. Later, a class action lawsuit was filed against the leadership of Eqonex, including Jonathan Farnell. The plaintiffs claimed that the management misled investors.

This fact is a red flag. The CEO’s involvement in a project that ended in collapse and litigation calls into question his ability to manage risk and act in the best interests of clients.

Freedx’s opaque regulatory structure and questionable facts from its management’s biography are serious causes for concern in 2025. Some exchanges, on the contrary, are betting on openness and licensing in many jurisdictions. We analyzed how Bitget’s “expansion through compliance” strategy and the publicity surrounding its CEO are changing the rules of the game.

Financial Transparency: The Black Box

In today’s crypto world, trust is built on proof. After the collapse of FTX, two terms became standard:

- Proof of Reserves (PoR): Cryptographic proof that the exchange holds sufficient assets.

- SAFU (Insurance Fund): A fund to compensate users in the event of a hack.

Freedx has neither. Its public materials make no mention of a PoR system or the presence of an insurance fund. Users do not have the ability to verify the exchange’s solvency. In 2025, this is unacceptable.

The use of an external custodian, Fireblocks, for asset storage is a plus. This market leader uses MPC (Multi-Party Computation) technology, which eliminates a single point of failure by splitting the private key into parts. This reduces the risk of theft in the event of a hacker attack.

Marketing Blitz: How Freedx Attracts Users

Freedx launched a marketing campaign. As part of the “Launch Campaign V2”, the exchange allocated a prize fund of $3.3 million in airdrops and bonuses for the first 100,000 users.

Additionally, there is a referral program offering 25% of the fees from invited friends. This is a strategy for new platforms: attract traders through incentives.

For early users, this is an opportunity to receive bonuses, but such promotions do not replace the reliability and transparency of the exchange.

Main Feature: Flexible Position Management for Professionals

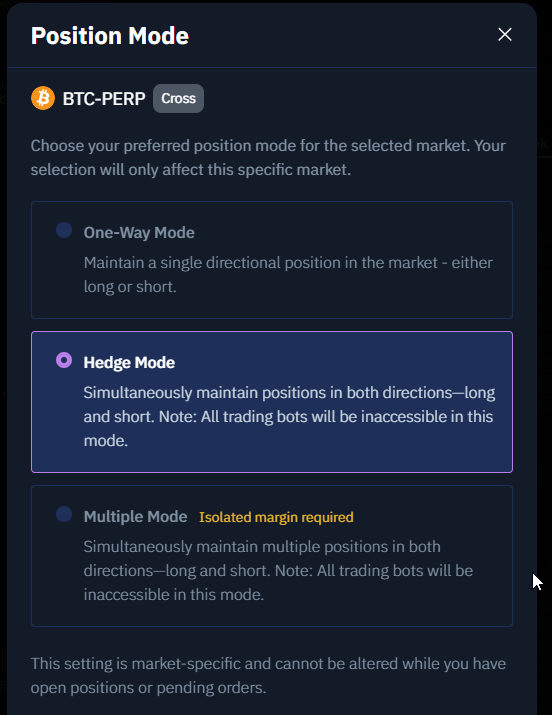

Freedx offers advanced position management modes that provide traders with flexibility. It is not simply “buy” and “sell” — it is an arsenal for strategy development.

Some of these modes, such as One-Way and Hedge Mode, are not new to Freedx. Similar functionality has become standard for many derivatives platforms, including Binance, Bybit , and OKX. Freedx adheres to the best industry practices. However, the combination of these modes and the inclusion of Multiple Mode sets the exchange apart as a tool aimed at professionals.

One-Way Mode

This is the standard mode. In it, you can hold only one position per contract — either long or short. If you have an open long on BTC-PERP and you open a short, your first position will close or reduce. Simple and clear, suitable for beginners and those adhering to simple strategies.

Hedge Mode

This mode allows you to simultaneously hold both long and short positions on the same contract. Why would you need that?

- Instant risk hedging: Imagine you hold a long-term long position in BTC, but you expect a correction. Instead of closing the position, you can open a short in hedging mode. If the price falls, you profit from the short, offsetting the losses on the long.

- Lock in profits without closing the trade: Your long is in the money, but you fear a pullback? Open a short of the same size. This “freezes” your profit, protecting it from market fluctuations.

- Implementing complex strategies: Hedge Mode opens the door for arbitrage, pair trading, and other techniques where managing opposing positions is necessary.

Multiple Positions Mode

This is an advanced version of Hedge Mode. It allows the opening of several independent long and short positions on the same market, each with its own margin and leverage settings (when using isolated margin).

This provides increased control. For example, you can open one long-term long position with low leverage and several short-term speculative positions (both long and short) with higher leverage, managing the risk of each individually.

Note: Switching between these modes is only possible when you have no open positions or active orders in the given market. These tools are intended for experienced traders who understand the mechanics of futures trading and risk management.

Verdict: Who is Freedx Suitable For?

Freedx offers powerful and innovative trading tools, such as Hedge Mode and Multiple Mode. The platform obtained a license in El Salvador and uses a custodial solution provided by Fireblocks.

On the other hand, there are transparency issues. The absence of Proof of Reserves and an insurance fund, anonymous investors, and a history associated with the CEO’s previous project create “blind spots.”

Recommendation:

- For beginners and long-term investors (“hodlers”): Not recommended. The risk of capital loss due to a lack of transparency and management issues is too high.

- For experienced traders and speculators: The advanced position modes may be attractive for executing strategies. However, you should consider any funds on Freedx as high-risk capital. Use the exchange for short-term trades, not as a place to store funds.

Freedx is a tool with potential, but also with risks. Before you click the

weigh all the “pros” and “cons.” In the world of cryptocurrencies, caution is important.