You’ve probably heard about Bybit. This exchange burst onto the crypto market and by 2025, it seemingly secured second place after Binance, grabbing a decent piece of the pie. The ads promise us a super-duper professional platform, an instantaneous engine, and a ton of opportunities for making money. But is everything really rosy? Is Bybit truly a reliable haven for your hard-earned cash, or is it just another offshore “ghost ship” with a pretty facade, ready to sink at the first sign of a storm?

To figure out whether Bybit can be trusted, I conducted my own investigation. First, let’s see how the exchange markets itself, and then we’ll dig deeper and analyze the facts that aren’t immediately obvious. Read on until the end, because as we know, the most interesting things lie in the details.

Fundamental Audit. Is it even worth trusting Bybit with your money?

Before discussing trading bots and futures with 100x leverage, let’s answer the main question: won’t this exchange vanish tomorrow along with your money? That, you see, is the basic level of trust. If Bybit doesn’t meet that, then there’s nothing to watch further.

Bybit and Regulators: A Game of Hide and Seek Around the World?

At first glance, everything seems fine with Bybit’s legalization. The exchange, founded by Ben Zhou in 2018, has proudly claimed since 2022 that its headquarters are located in Dubai, UAE. This move is not accidental, but part of a strategy to establish itself in crypto-friendly jurisdictions. Bybit is actively obtaining licenses: first a provisional, and then a full operational license in Kazakhstan from the AFSA (Committee of the MFSA for regulating financial services), as well as a provisional license from Dubai’s Virtual Assets Regulatory Authority (VARA).

Sounds convincing, doesn’t it? But let’s look at the situation from another angle. Legally, the parent company, Bybit Fintech Limited, is registered in the British Virgin Islands (BVI). And now let’s open the list of countries from which user access to the exchange is banned: the USA, China, Singapore, Canada, France, the United Kingdom. In other words, all the largest and most strictly regulated markets in the world.

What does this mean for you as a trader? This is a classic “regulatory arbitrage.” Bybit gets shiny licenses in lenient countries to appear legitimate, while its primary structure is offshore (BVI), which allows it to avoid strict control and offer risky products, such as 100x leverage, which would be impossible under the supervision of the American SEC.

Conclusion: Registration in the BVI gives the exchange free rein, and for you – weak legal protection. In the event of a major dispute or the platform’s bankruptcy, your chances of getting your money back through the courts in the BVI jurisdiction approach zero. All the legal risk is transferred from the exchange to you. This is the price for access to high-risk instruments.

Bybit’s Doomsday: How a $1.5 Billion Hack Paradoxically Proved that the Exchange is “Alive”

Updated: February 2025. On February 21, 2025, an event occurred that was supposed to destroy Bybit. The North Korean hacker group Lazarus Group carried out the largest theft in the history of cryptocurrencies, stealing assets worth about $1.5 billion from the exchange’s wallets. The attack was not carried out directly but through a breach of a third-party platform for multisig wallets, Safe{Wallet}, which allowed for transaction manipulation and fund redirection.

Any other exchange in its place would most likely have shut down. But Bybit’s reaction became the most powerful stress test in the history of the industry.

- Transparency: CEO Ben Zhou immediately announced the hack and assured that all client assets were secured 1:1 and that losses would be covered by the company’s funds.

- Solvency: Most importantly – Bybit did not stop withdrawals. In the first few hours after the hack, outflows totaling billions of dollars were processed. This sparked a classic “bank run” that the exchange withstood, proving that its reserves are real.

- Acknowledgment of Mistakes: Later, Zhou admitted that the exchange was aware of the potential security risks associated with the third-party provider but failed to take action in time. This is a serious failure in risk management, but the acknowledgment itself is a rare instance of honesty in this field.

Conclusion: This catastrophic security failure, strangely enough, became the most convincing proof of Bybit’s financial stability. Unlike FTX, where the hack merely exposed a gap in the balance sheet, Bybit was fire-tested. The risk shifted from “Are my funds there?” to “How well are they protected?” The solvency risk, which is fatal, was largely eliminated.

Proof of Reserves and the Insurance Fund: A Marketing Ploy or Real Protection?

After the collapse of FTX, all exchanges began clamoring about “Proof of Reserves” (PoR). Bybit is no exception. They use a system based on Merkle Trees, which allows each user to verify that their balance is accounted for in the overall audit. Audits are carried out every month by the independent company Hacken, and the reserve ratios for all assets consistently exceed 100%.

But, as we have already found out, the best test is the real “bank run” that Bybit withstood.

In addition to PoR, Bybit has an Insurance Fund. It is important to understand that these are not the same.

- Proof of Reserves answers the question: are client funds secured 1:1? (Solvency risk).

- The Insurance Fund answers the question: what will happen if the market crashes and mass liquidations begin? (Market mechanism risk).

The Insurance Fund is designed to cover losses on liquidated positions in order to prevent the automatic deleveraging mechanism (ADL), where profitable traders’ positions are forcefully closed to cover the deficit. The fund’s balance is transparent and updated daily.

Conclusion: Bybit demonstrates a serious approach by separating two key risks. PoR gives the assurance that the exchange is not a financial pyramid. The Insurance Fund gives derivatives traders confidence that their profitable trades will not be forcefully closed due to market chaos. This dual protection system sets Bybit apart from many competitors.

A Digital Fortress with a Crack: Analyzing Bybit’s Cybersecurity

Bybit employs a standard set of security measures: cold wallets, 2FA, anti-phishing codes. Moreover, they have an active Bug Bounty program on the HackerOne platform with rewards up to $100,000 for critical vulnerabilities. After the hack, a separate “LazarusBounty” program was launched to recover the stolen funds.

Sounds pretty good, but there is one “but”: the 2025 hack still happened. And it occurred not because of a vulnerability in Bybit’s own code, but due to a breach of a third-party provider. This reveals a weak spot. The Bug Bounty program is aimed at finding holes in the exchange’s own systems. Yet the security of the entire platform turned out to be only as strong as the weakest link in its supply chain.

Conclusion: Bybit protects its own territory well, but the hack showed that their process for checking and managing risks associated with third-party integrations failed dramatically. Although after such a lesson they certainly strengthened control, for a trader it means that the risk of a similar incident happening through another provider, while reduced, has not completely disappeared.

Analyzing the Trading Ecosystem. Can You Earn “Alpha” Here?

So, we’ve established that Bybit is unlikely to disappear along with your money. Now let’s see whether it offers any real advantages for trading.

A Pro’s Engine, a Trap for Beginners? Dissecting Bybit’s Liquidity and Fees

Bybit offers some of the lowest fees on the market, especially on derivatives: around 0.02% for makers and 0.055% for takers, putting it on par with Binance and OKX. This makes the platform very attractive for active traders.

Table 1: Fee Comparison (Bybit, Binance, OKX) – Base Levels as of August 2025

| Exchange | Spot Maker | Spot Taker | Futures Maker | Futures Taker | Notes |

|---|---|---|---|---|---|

| Bybit | 0.100% | 0.100% | 0.020% | 0.055% | Highly competitive derivatives fees. |

| Binance | 0.100% | 0.100% | 0.018% | 0.045% | Slightly lower on futures. Discounts available with BNB. |

| OKX | 0.080% | 0.100% | 0.020% | 0.050% | Maker fee a bit lower on spot trading. |

Regarding performance, according to the analytics firm Kaiko, after the hack in February 2025 the liquidity on the BTC-USDT pair was fully restored within 30 days, and slippage for large orders returned to previous levels. This is a serious vote of confidence from professional market makers.

However, if you read the reviews on Reddit, the picture looks a bit different: users often complain about platform overloads, order freezing, and a useless support service during periods of high volatility.

Conclusion: These two facts do not contradict each other. The core trading engine of Bybit, which is accessed by big players, is working excellently. However, the external layer (web interface and public API for regular clients) does not withstand peak loads. This is an exchange with a “priority for institutional clients“. If you are a professional algo-trader – this is your paradise. If you are a retail trader trying to execute a market order during panic, be prepared for problems.

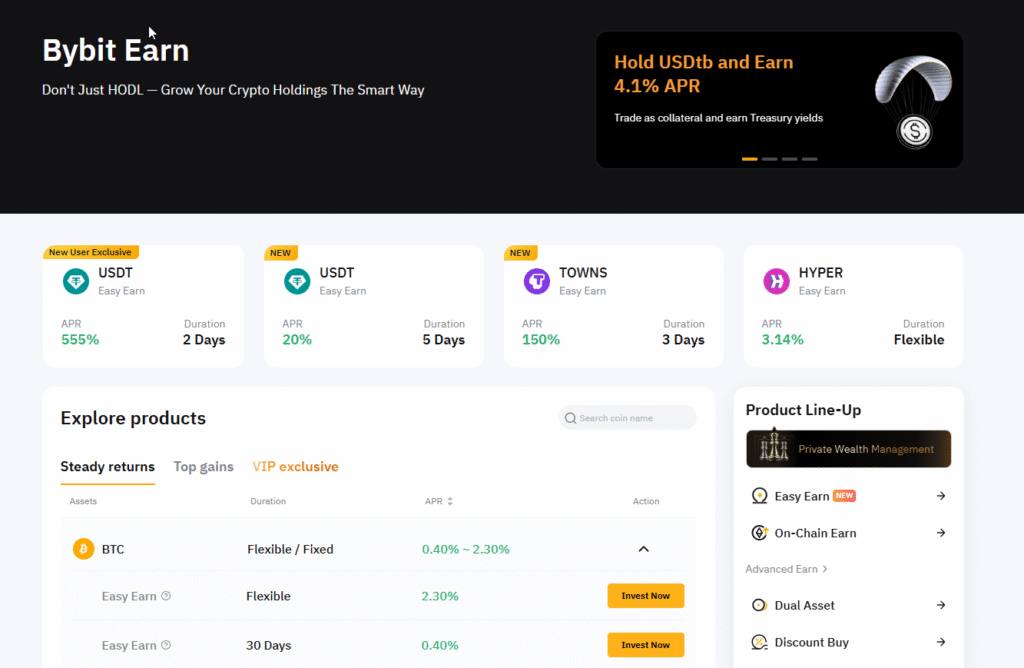

Passive Income or Passive Losses? Evaluating Bybit Earn and Launchpad

Bybit offers a set of products for earning. The “Easy Earn” program is positioned as low-risk, and importantly, the exchange openly discloses the income sources: on-platform lending (“Savings”) and third-party low-risk strategies (“Wealth Management”). This sets it apart from platforms that offer unreal returns out of “thin air” (i.e., from a marketing budget).

The Bybit Launchpad platform gives early access to tokens of new projects. However, according to TokenHunter data for 2023, the average return on investment (ROI) here was 15.11x, which is lower than that of competitors: OKX (34.56x) and Binance (29.01x).

Conclusion: Bybit does not try to lure users with unreal percentages or super-profitable but risky IEOs. Their approach is more cautious and transparent. “Easy Earn” is a decent place to park idle funds, and Launchpad is an opportunity for structured, risky bets, but not a “money printing machine” like some competitors.

An Arsenal for “Alpha” or Tools for Draining Your Deposit?

Bybit offers several interesting tools that are presented as a way to gain an advantage (“alpha”).

- Pre-Market Trading: A unique opportunity to trade tokens before their official listing. It sounds enticing, but in reality, this is a market with low liquidity, huge spreads, and wild volatility. This tool is for experienced speculators, not beginners.

- Trading Bots: Bybit offers a free set of bots: grid, DCA, Martingale. However, it should be understood that a bot is just an automation tool. A grid bot will lose money in a strong trend, and a Martingale bot is a straight path to losing your entire deposit if the market moves unfavorably.

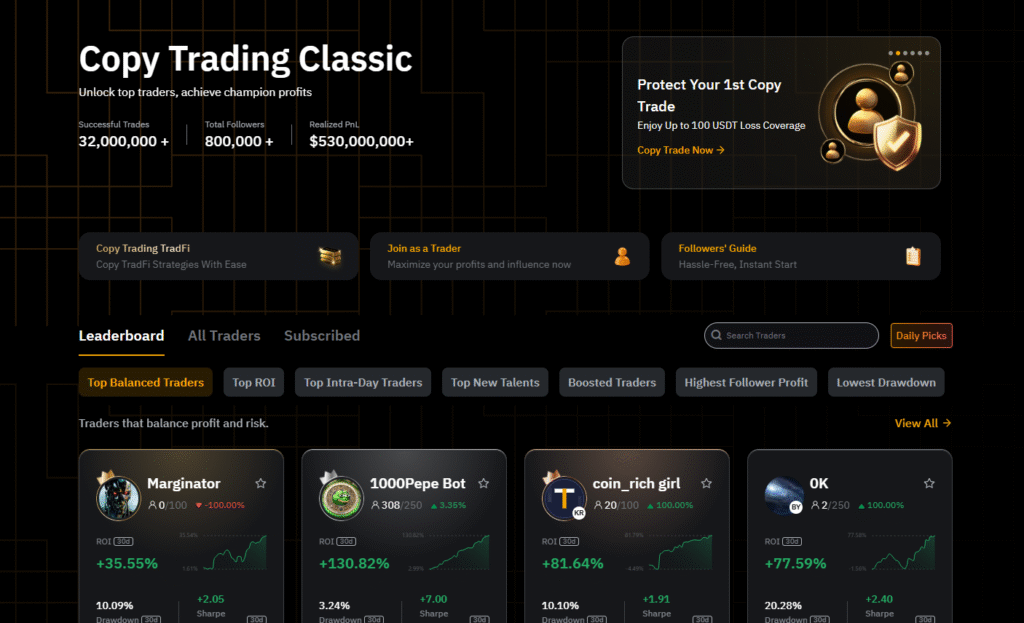

- Copy Trading: The opportunity to copy the trades of “Master Traders”. However, reviews often recount stories of “masters” with perfect statistics wiping out subscribers’ accounts overnight by opening risky trades.

Conclusion: All these tools are double-edged. They can increase profits for a trader with a clear strategy and proper risk management, but they will undoubtedly accelerate the loss of a deposit for a beginner looking for a “magic button.” Bybit provides a powerful arsenal but not an instruction manual for its safe use.

The MNT Token: Real Utility or Just a Ticket to Launchpad?

Unlike Binance with its BNB, Bybit does not have a classic exchange token. Instead, the exchange supports the Mantle (MNT) ecosystem – a second-layer (L2) network token. For a Bybit user, the main benefit of owning MNT is participation in the Launchpad: the more MNT you own, the larger your share in new projects.

Conclusion: Bybit has decided to separate its success from a token. This means that by buying MNT for access to the Launchpad, you are not betting on the exchange, but on the success of a separate L2 network, Mantle. This complicates evaluation and adds additional risk. It is not just a token for fee discounts, but a full-fledged investment asset with its own risks that are not directly linked to the exchange.

Final Verdict. Who is Bybit Suitable for and Who Should Stay Away?

SWOT Analysis for the Trader

Strengths:

- An elite derivatives platform: Good liquidity and low fees.

- Proven solvency: Withstood a “bank run” after a $1.5 billion hack.

- Unique tools: Pre-Market Trading and built-in bots offer opportunities for “alpha.”

- Transparent Earn products: Clear sources of income.

Weaknesses:

- Security failure: The hack via a third-party provider is serious.

- Instability for retail: Complaints about interface and API lags during volatile periods.

- Limited utility of the MNT token: Mainly needed for access to the Launchpad.

Opportunities:

- Market share growth: Actively capturing market share from competitors.

- Regulatory flexibility: Offshore status allows for rapid implementation of new, albeit risky, products.

Threats:

- Risk of regulatory tightening: Sudden changes in rules in Dubai or global measures against offshore exchanges.

- An attractive target for hackers: The platform remains a prime target for hacker groups.

- Fierce competition: Constant struggle against giants like Binance and OKX.

Final Recommendation and Trader Profile

Bybit is not a one-stop crypto shop. It’s a specialized tool which, in the right hands, can become a scalpel, and in the wrong ones – a sledgehammer.

Who is Bybit suitable for?

- The derivatives specialist and algo-trader: For you, Bybit is almost the ideal place. Low fees, good liquidity and a stable core engine – it’s everything you need. You are experienced enough to understand and accept the legal risks of offshore registration.

- “Alpha Hunter”: You are attracted to unique opportunities such as Launchpad and Pre-Market Trading. You understand their risks and use them for targeted speculation.

Who should stay away?

- Long-term investor (“HODLer”): Keeping large sums on an exchange registered in the British Virgin Islands with a history of a major hack is not the best idea. For long-term storage, use hardware wallets or exchanges with serious regulation in top-tier jurisdictions, such as Bitget.

- Beginner trader: For you, Bybit is a minefield. High leverage, complex instruments, and poor support in crisis moments make for a recipe for rapid deposit loss.

The Three Pillars of Bybit: What Really Supports the Exchange?

- An excellent derivatives platform: Bybit is primarily a futures exchange. Everything else is secondary. This focus ensures good liquidity and conditions for professional traders.

- Access to pre-listing “alpha”: The Pre-Market Trading platform is their real advantage, offering an opportunity that most competitors lack.

- Proven resilience: After FTX’s collapse, Bybit’s ability to withstand an actual “bank run” is the most important argument for its financial reliability.