Founders and Team

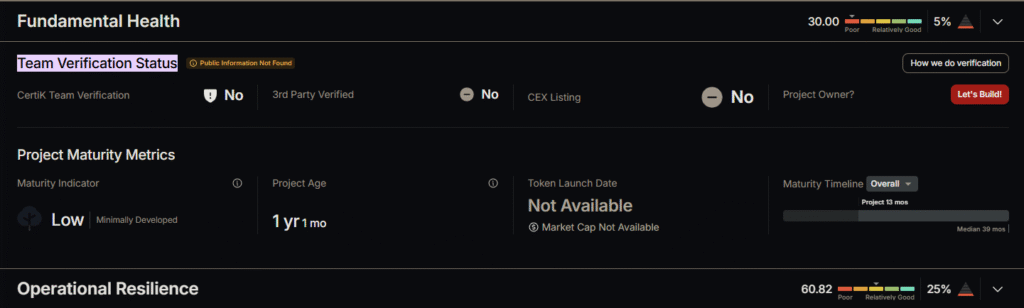

There is no information about the creators of BitNest. The project is positioned as decentralized with no clear leadership. The auditor company CertiK notes on its platform: “public information is absent”, and team verification was not conducted.

As a result, the project team is effectively anonymous, which is a serious risk.

In-depth analysis of Disclaimer and Terms of Use of BitNest

- “We are nobody and everywhere at the same time”

At the very beginning they state something like:

“BitNest does not belong to any country whatsoever and is not subject to any jurisdiction.“

Essentially, this means that the project has neither a legal entity, nor an office, nor a country where it is registered, nor any controlling authorities. It is not just decentralization, it is an intentional renunciation of any legal affiliation. If something goes wrong, there will be no one to ask.

- “Everything at your own risk”

They explicitly warn:

“The platform gives no guarantees and does not compensate for asset fluctuations…“

If you think about it, this means:

Any losses (due to hacking, errors in the smart contract, market crashes, or project shutdown) are solely your problem. Even if their code is at fault, they preemptively disclaim any liability.

- “We can change everything whenever we want”

They reserve the right to:

“…change, update, suspend or terminate the operation of the protocol… without notice.“

Combined with the absence of any jurisdiction, this means:

Tomorrow they may disable fund withdrawals. They may change or remove income accruals. Or they might simply shut down the project, leaving you with nothing to do.

- “We can block you permanently”

At the same time, they openly state:

“…restrict access to the platform through on-chain blacklists.“

In combination with the right to change the rules, this means:

They can block your wallet for any reason. And blocked funds will remain permanently on their smart contracts.

Final conclusion regarding the documents

The essence of their Disclaimer and Terms of Use boils down to three simple phrases:

- We do not abide by any laws.

- We are not liable for anything.

- We can change everything or block you at any moment.

This is a classic legal “safety cushion” for the anonymous hype administrators, which in a real business looks like a complete renunciation of any obligations.

Repository and Technical Implementation

The open source code or repository of BitNest is not presented. The platform uses smart contracts on EVM blockchains (Ethereum/BSC). It is claimed that “BitNest Loop” runs on Ethereum, “BitNest Savings” on BSC, and “Saving Box” on PancakeSwap (BSC). In CertiK’s public report, one contract BitNest.sol with code on BSC is indicated (see link on BscScan).

The audit claim regarding “Solana” appears strange, as the actual contract is deployed on BNB Chain rather than Solana. It is important to note that the project does not have a public GitHub: all functionality is embedded in smart contracts whose code is not available for public viewing.

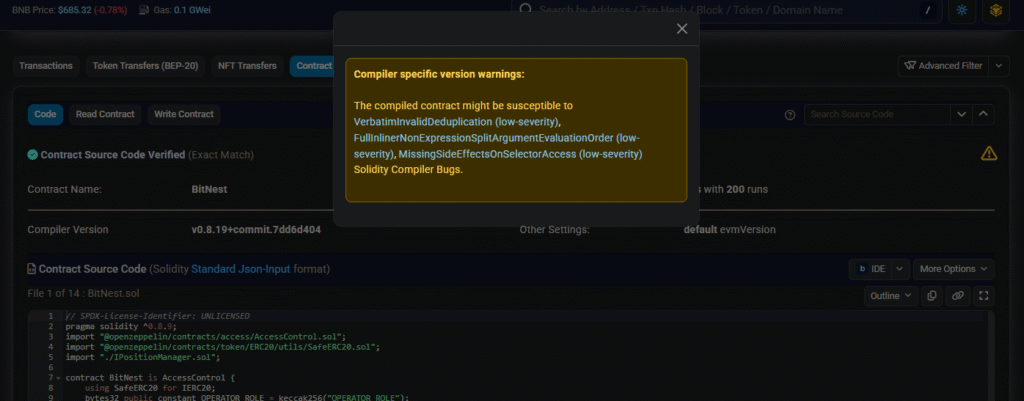

If you click on the warning, you see the following (I translate) – The compiled contract may be vulnerable. For a serious project, this is unacceptable!

Smart Contracts and Audit

The main BitNest contract (address on BSC) was uploaded after passing the audit (deployment date 30.05.2024). CertiK claims that the contract owner’s rights have been renounced and there are no privileges, which seemingly increases trust. CertiK confirmed the correctness of the logic (9/9 formal properties passed) and the resolution of all identified issues. However, CertiK itself clarifies that “the audit does not guarantee the project’s viability, the safety of investments, or legal compliance“.

An independent analysis indicates vulnerabilities: for example, a note in the audit warns about “centralization” due to excessive administrator rights (even if the rights were supposedly renounced), about complete token approval (Max Approve) without limits, and about dependency on PancakeSwap as a “black box”. Overall, CertiK identified 4 issues (2 solved, 2 “pending”), without critical ones, but refused to review the economic model.

Thus, from a technical standpoint the contract code has been checked, but questions of trust remain (closed testing of third-party protocols, unclear administrator capabilities).

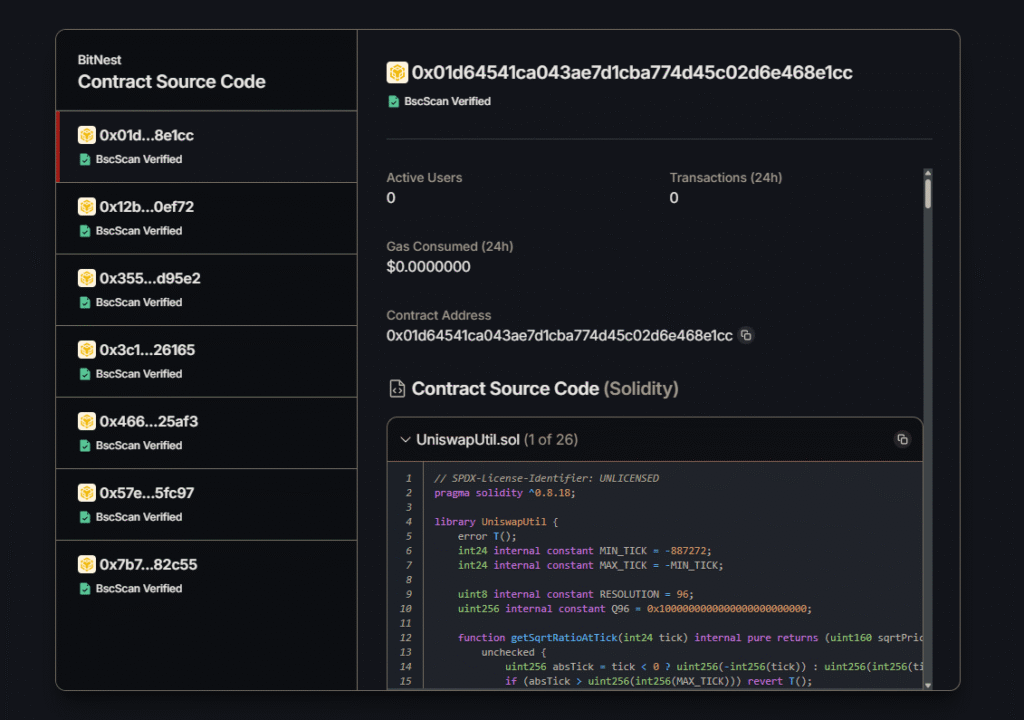

And a very strange thing. For all 7 smart contracts there are no transactions. And the Pancake contract they mention is not present on the auditor’s website! It was not audited.

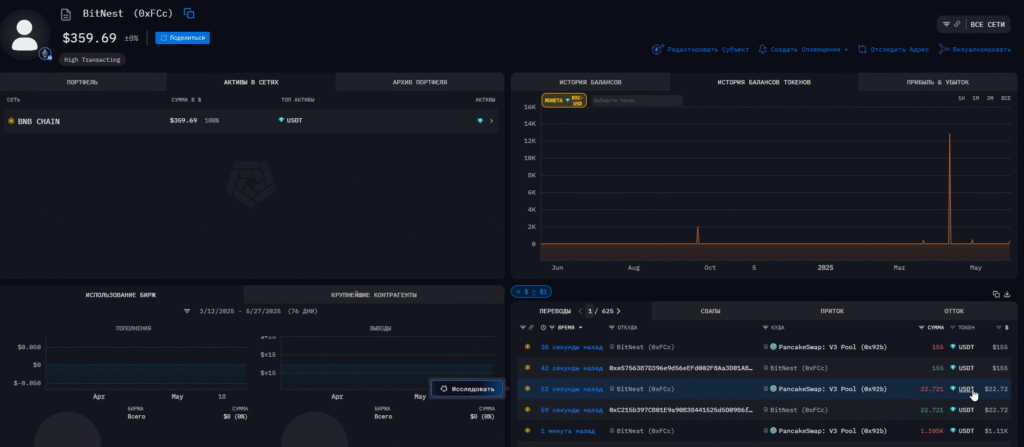

Moreover, it gets even more interesting. The smart contract mentioned in the auditor’s report, when examined closely, shows an interesting picture – the contract balance is $359, and everything goes transit to PancakeSwap, so where is the $22,000,000 mentioned by one blogger? Could it be that they paid the organizers’ salaries?

And no funds in other networks.

Tokenomics and Business Model

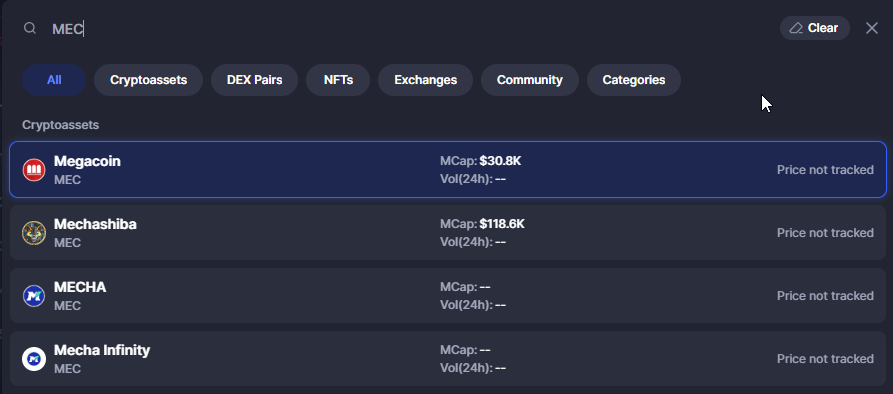

The native token Mellion Coin (MEC) is a BEP-20 token on Binance Chain. The project’s publications speak of a “token sale” and distribution to support the ecosystem, but details are not revealed: there is no public data on nominal supply, issuance, or distribution.

On CoinMarketCap, it is empty, with no mentions; there are some tokens, but they are unrelated to our project. Even if it appears on some crypto dumps, it does not improve the project, it is not that valuable.

The official white paper and website focus on the functionality of investors depositing money (deposit cycles “loop” and “savings box”), promising a stable income. For example, user reviews mention a daily profit of “0.4%” (≈12.55% per month) and a fixed return of 124% in 28 days.

This model in essence is a Ponzi scheme (a scam – in our opinion): payments to some participants are provided by new investments. Access to income programs requires depositing tokens and/or burning MEC tickets.

In addition, multi-level referral rewards (up to 17 levels) have been announced. At least it is not binary or matrix marketing. These “income schemes” are classic “pyramid schemes” – payments are guaranteed only with a continuous inflow of new investors.

The project lavishly promises a huge audience, multi-million dollar capitalization, and other wonders (“50 million users”, “$1000 per token”, etc.), which seems unlikely and is not supported by any real metrics.

Overall, the tokenomics appear opaque and designed to quickly attract the crowd: the lack of distribution details and aggressive income promises are clear “red flags“.

Social Networks, Media, and Forums

The project is actively promoted on social networks and messengers. BitNest has a Telegram channel, pages on Facebook and Instagram with posts in several languages, as well as a bot and a channel on YouTube/Rumble.

Marketing messages promise “financial freedom”, “simple passive income”, and “low risks” (typical MLM slogans). For instance, on YouTube there is a video titled “Financial Freedom – Passive Income – Simple – Low Risk”, etc. On X/Twitter, the account @BitNest_ publishes similar statements.

On Binance Square (a user section of Binance, for which the exchange is not responsible for the information) a post appeared where an anonymous author claims that BitNest has “relevant licenses” and complies with the law (this information is dubious, as it was published unofficially).

Information about the project is actively spread by referrers. There have been investigations, and one researcher publicly linked BitNest to the figure Munir Ali Kaid-Al Jannedi, also known as “Mr. Jannedy”, and to the name Mellion Coin, pointing out similarities with previous crypto scams.

On forums (for example, MMGP) participants discuss earnings from “loop” and “savings box” with clear signs of hype. In the thread titled “Forum on Pseudo-investments/MLM games”. And these guys have been through all sorts of scams.

On Reddit there is a short post advertising BitNest, where the author urges “don’t be scared, it’s not a scam” (in English “Not a scam, trust me on this”) – a classic tactic to convince potential investors.

Overall, the reputation of the project is clear: on one hand, there is a lot of noise and “guaranteed” success stories (stories about cars and money), and on the other – independent reviews are cautious or critical.

Blockchain Activity and Metrics

At the time of checking, blockchain activity is minimal. According to CertiK, in the last 24 hours the main contract has 0 active users and 0 transactions. This is consistent with the absence of public token trading statistics (volumes on exchanges are not disclosed).

At the same time, user posts claim significant liquidity: one MMGP participant mentioned approximately 22 million dollars in the PancakeSwap pool.

No official confirmations of this figure have been found: BitNest does not appear on well-known trackers. There is no data on exchange volumes or the number of depositors. Thus, the actual metrics (transactions, turnover) are unknown and, judging by official data, close to zero.

Key Risks of the BitNest Project

| Risk | Description and Facts |

|---|---|

| Anonymity of the Team | No reliable information about the developers or leaders. CertiK notes “no public information” about the team. Anonymity makes it difficult to identify responsible individuals. |

| Lack of Licenses | Despite claims (see press release and post on Binance Square) about “registration in the USA” and “having licenses”, verified information on regulatory approvals is absent. These claims appear to be a marketing tactic. |

| Unreliable Audit | The CertiK audit was conducted and published (report dated 29.05.2024). All identified issues were formally resolved. However, CertiK warns that the audit does not guarantee business safety. Independent reviews point to potential “backdoors” (centralized risks) and vulnerabilities (maximum approval). |

| Ponzi/MLM Model | The payout structure is clearly MLM: promises of fixed high returns (“0.4% per day”, “124% in 28 days”) and a 17-level referral scheme. It is classified as a pyramid/Ponzi scheme. There is no stable source of income; payouts are made from new depositors. |

| Marketing Tricks | Aggressive advertising calls the project “risk-free” and “comfortable”; on forums and social networks, referrers echo this. Promises of “financial freedom” are accompanied by exaggerated testimonials. Such hype is typical for scam projects. |

| Dubious Tokenomics | There is no transparency regarding the issuance and distribution of the MEC token. It is only known that the token is used for deposits and rewards. It is unclear how many tokens are on the market and who controls them. |

| Reliance on Protocols | The smart contract relies on PancakeSwap and other services (assessments indicate a “black box” of requirements). Changes in third-party contracts or their vulnerabilities can negatively affect your investments. |

| Overly Optimistic Plans | The project puts forward unrealistic long-term plans (tens of millions of users, rapid payment adoption, support for multiple blockchains). These claims are not supported by real achievements or partnerships. |

Each of the listed risks indicates an increased likelihood of fraud or project failure: anonymity and lack of proper regulation combine with a flashy marketing veneer, which is typical for financial pyramids.

The sources of information for this analysis are: the official BitNest/GitBook website, CertiK (Skynet), forum discussions, as well as analytical publications by independent experts. Every claim is based on available data.

Personal Recommendations on BitNest

And now my personal recommendations. I don’t care how you spend your funds. They are yours. But before you invest your money in a suspicious enterprise, read the article Ai Marketing SCAM, there won’t be any money. Who is behind the Ai Marketing scam? A detailed analysis of earnings. In it, I thoroughly discuss the method for analyzing projects like BitNest. And be sure to read the comments; you will find 90% of the answers to your questions there.

Never take things at face value, especially if you hear about extraordinary earnings from your acquaintances who, in reality, only ever earned a salary.

If you want to create a passive income that works, forget about “magic pills” and consider real business. For example, international real estate – a time-tested option backed by economic cycles.

Today you can start with small investments from $50 to become a co-owner of an apartment, in Bali or in the States, and receive a stable income in foreign currency. And importantly, without the risk associated with cryptocurrency volatility.

By the way, here are a few areas worth considering:

- Real estate in Bali, Montenegro, Turkey, and the UAE. There are many interesting projects now starting from $50 per share.

- Apartments and hotels in the Dominican Republic, Argentina, Spain, Mexico, the USA. You can start from €100. There are very attractive offers.

- Properties in the USA and Mexico. The North American market has always attracted investors.

- Real estate in the USA and the EU. This could be a good way to start investing.

And one more thing, each of these companies has a referral program. But not some pyramid, rather a genuinely working model.

Blockchain? Yes, but wisely. Blockchain opens up new opportunities in the investment market. But the main thing is not to chase hype, but to choose projects that have real value.

As a financial analyst and trader with experience, I can say: passive income is built on facts, not on empty promises.