Bitget in 2025 – A Look at the Giant. What Is Really Happening Behind the Scenes?

Promises of easy money, revolutionary tools, and access to markets that will make you rich… Sounds too good to be true, doesn’t it? In the world of cryptocurrencies, where many projects turn out to be bubbles, I always view grand claims with a healthy dose of skepticism. Bitget is no exception. This exchange positions itself as a leader in copy trading and derivatives trading, but is that really the case? I decided to take a closer look.

On one hand, the numbers are impressive. By 2025, Bitget had become a global giant with over 120 million users. Its copy trading platform, with 1.1 million subscribers, is truly the largest in the world. Plus, there are reports of high liquidity in altcoins, even surpassing Binance and Bybit in some cases, and a Launchpad platform with announced yields in the tens of x’s. Tempting, isn’t it?

But there’s also a downside. Regulatory uncertainty remains. Bitget is actively obtaining licenses worldwide, but the rules in the crypto industry can change at any moment. And, of course, there is market risk: leverage up to 125x can quickly wipe out your deposit.

So, who is this exchange for? Beginners and passive investors might see copy trading and bots as the “holy grail.” Active altcoin traders may be attracted by liquidity. Algo traders will appreciate the API. And “gem hunters” will keep an eye on the Launchpad and the BGB token. But before putting your money in, it’s important to understand if it’s worth it.

Corporate Strategy and Face of the Brand – Gracie Chen

From Anonymity to Trust: How Bitget Is Changing

Founded in 2018, Bitget remained in the shadows for a long time. But by 2025, it had become one of the key players with a daily trading volume of over 10 billion dollars. It is no longer just “another exchange” but an important market player.

A key moment in the strategy was the appointment of Gracie Chen as CEO in May 2024. This wasn’t just a change in leadership, but a deliberate shift towards building a global brand based on trust. After the collapse of FTX, anonymous founders and offshore registrations raised more and more questions. Bitget is betting on transparency.

Who is Gracie Chen? She has an impressive background: an MBA from MIT, a decade of experience in business and investments, and a previous role as managing director where the user base quadrupled. She is a media personality, a Forbes columnist, a conference participant, and an advocate for gender diversity in Web3 (as evidenced by the #Blockchain4Her initiative with a 10 million dollar fund). Appointing someone like her sends a clear signal to the market: “We’re here for the long haul, and we have nothing to hide.”

The Ecosystem as a “Fortress”

Bitget’s strategy is not just about a trading platform, but the creation of a closed ecosystem from which it will be difficult for the user to leave. An important step was the acquisition of the BitKeep crypto wallet (now Bitget Wallet) in 2023. This gives users access to DeFi without leaving Bitget.

In addition, the exchange is developing its own venture units, such as Foresight Ventures with assets under management of 400 million dollars. This provides early access to promising projects that are later launched on Bitget Launchpad. Essentially, the exchange invests in projects, helps them grow, and then offers them to its user base.

For a trader, this is a double-edged sword. On one hand, there is access to vetted projects and convenience. On the other, it’s a dependency on one ecosystem. The choice is yours, but it’s important to understand how it works.

Playing by the Rules? The Regulatory Labyrinth

Bitget has chosen the path of “expansion through compliance.” Instead of hiding in offshore jurisdictions, the exchange is obtaining licenses in key jurisdictions. This is a long and expensive process, but it reduces risks, such as the sudden blocking of the platform.

By 2025, Bitget was registered in European Union countries, and it is preparing for the implementation of the Markets in Crypto-Assets Regulation (MiCA). Here is a list of key jurisdictions:

- Poland: Registered as a Virtual Asset Service Provider (VASP). Information can be found in the Public Information Bulletin.

- Lithuania: Registered as a VASP under the supervision of the Financial Crime Investigation Service (FCIS). Lists of operators are available on the State Register Center website.

- Bulgaria: Obtained a VASP license from the National Revenue Agency (NRA) in February 2025. The register can be found on the NRA website.

- Italy: Registered in the special register for virtual currency operators.

- United Kingdom: Authorized to operate, working with a partner approved by the Financial Conduct Authority (FCA). You can check the status in the FCA register.

- Georgia: Obtained a license to operate in the Tbilisi Free Zone (TFZ) in June 2025. Information about companies can be found in the Public Register of Georgia.

The basis of this strategy is compulsory Know Your Customer (KYC) verification for all users. This drives away the anonymous, but attracts serious investors for whom regulatory clarity is important. Bitget believes that the future of the crypto market lies with regulated platforms.

Protecting Your Capital: A Security Analysis

Two Pillars of Trust: Proof of Reserves and the Protection Fund

After the collapse of FTX, the question “Where is my money?” became paramount. Bitget answers with a two-tier system: monthly Proof of Reserves (PoR) reports and a Protection Fund. Let’s see how reliable this system is.

Proof of Reserves (PoR): Are the Funds There?

PoR reports are meant to show that the exchange holds client assets at a 1:1 ratio or higher. Bitget uses a cryptographic method based on the Merkle tree and publishes reports monthly. The source code for verification is open on GitHub.

Data as of July 2025 shows an overall reserve ratio of 175%. This means that for every dollar of client funds, the exchange has $1.75 in reserves. A breakdown by asset:

- BTC: 311%

- ETH: 151%

- USDT: 102%

- USDC: 267%

Such over-collateralization creates a buffer in case of market fluctuations and speaks to the financial stability of the exchange.

Protection Fund: Insurance Against “Black Swans”

The Protection Fund is designed to compensate for losses from external threats, such as hacking attacks. It is a self-financed fund from Bitget’s own capital.

Its size is constantly growing. Starting from $300 million, by July 2025 it reached $779.7 million. The fund consists of liquid assets (6,500 BTC and USDT), and its wallet addresses are public.

This dual system is a well-thought-out risk management strategy. PoR confirms solvency, while the Protection Fund insures against disasters. For a cautious trader, this is an important argument in favor of Bitget.

Digital Fortress: Technical Security

Financial guarantees are useless if the infrastructure is vulnerable. Bitget pays attention to this, as confirmed by its ISO 27001:2022 certification.

The majority of assets are stored in cold wallets with multi-signature. To detect vulnerabilities, Bitget uses bug bounty programs on platforms like Bugrap.io, offering rewards of up to $1,000,000 for finding bugs.

The most important indicator is the absence of hacks and serious incidents since its founding in 2018. In an industry where news of breaches regularly appear, this is a significant achievement.

The Trader’s Arsenal: In Search of “Alpha”

Battlefields: Spot and Derivatives Markets

Bitget offers two main markets for traders, each with its own rules and opportunities.

Spot Market: Paradise for Altcoin Traders?

Bitget’s spot market offers variety. The platform provides over 800 coins and 700 trading pairs. This opens up opportunities for diversification, discovering “hidden gems,” and arbitrage. The main advantage here is liquidity.

Derivatives Market: Flagship Territory

It is the derivatives market that made Bitget one of the leaders. The platform offers:

- USDT-M and USDC-M: Perpetual contracts with stablecoin margin. By 2025, the number of USDT-M Futures pairs exceeded 500.

- COIN-M: Contracts with margin in the underlying asset, suitable for hedging.

Maximum leverage of up to 125x is a powerful tool that must be used wisely.

Copy Trading: The Grail or a Trap for Beginners?

Copy trading is Bitget’s calling card. But is it a simple way to make money?

For the Subscriber: How Not to Lose Money

The platform provides statistics for each “elite trader.” It is important to analyze them correctly:

- Subscriber PnL: The profit that the trader’s subscribers have earned.

- Maximum Drawdown: The greatest loss from the peak to the trough.

- AUM: The total amount of assets under management.

For the Elite Trader: Monetizing Skills

Experienced traders can receive up to 10% of the profits of their subscribers. The success of this model is based on the network effect.

Comparison of Copy Trading Features

| Characteristic | Bitget | Bybit |

|---|---|---|

| Metrics for choosing a trader | ROI, AUM, subscriber PnL, max. drawdown, trade history, achievement badges | ROI, subscriber PnL, AUM, win rate, stability, trade history |

| Risk management tools | Stop-Loss, maximum investment amount, leverage settings | Take-Profit/Stop-Loss, maximum margin, leverage settings |

| Profit distribution model | Up to 10% of subscriber profits | 10-15% of subscriber profits |

| Supported markets | Spot, Futures (USDT-M, USDC-M, COIN-M) | Spot, Futures (USDT Perpetual, USDC Contracts) |

| KYC Requirements | Mandatory verification | Not required initially, but withdrawal limits apply |

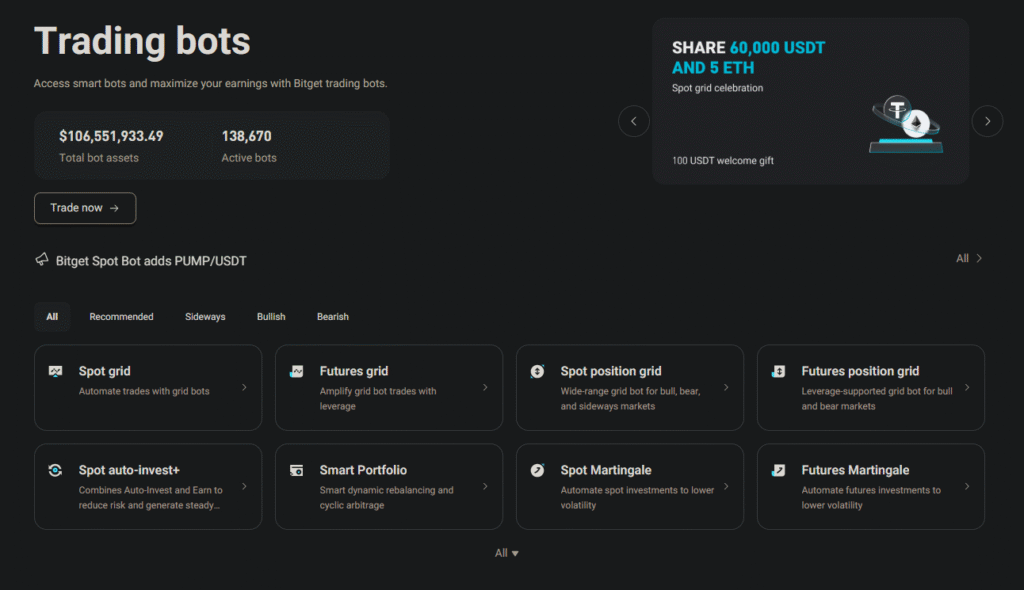

Army of Bots: Automating the Strategy

Bitget offers built-in trading bots. This is a tool that requires an understanding of the market.

The main types of bots:

- Grid Bot: For a ranging market.

- DCA Bot: For averaging down.

The platform offers AI-driven strategies for beginners and a manual mode for experienced traders.

Bitget focuses on social trading and simple AI strategies. Another market giant, however, has chosen the path of maximum customization for systematic traders. If you need more detailed control and access to complex algorithms, take a look at the trading bots on OKX.

BGB Token: The Fuel for the Ecosystem

Bitget Token (BGB) is not just an exchange token, but the glue that holds the Bitget ecosystem together.

Utility: What Is BGB For?

- Cost Savings: 20% discount on fees in spot trading.

- Yield: Enhanced rates in Bitget Earn and increased profit share in copy trading.

- Exclusive Access: Participation in Launchpad and Launchpool, as well as airdrops of new tokens.

- Governance: The ability to vote on the listing of new projects.

Tokenomics: A Deflationary Model

Bitget implements a quarterly buyback and burn mechanism, funded by the exchange’s revenue.

Beyond Trading: Passive Income and Early Investments

Bitget offers passive strategies.

Bitget Earn: Make Your Money Work

- Flexible Savings: Interest with the possibility of withdrawal at any time.

- Staking: Network rewards for staking PoS cryptocurrencies.

- Crypto Loans: Loans secured by crypto assets.

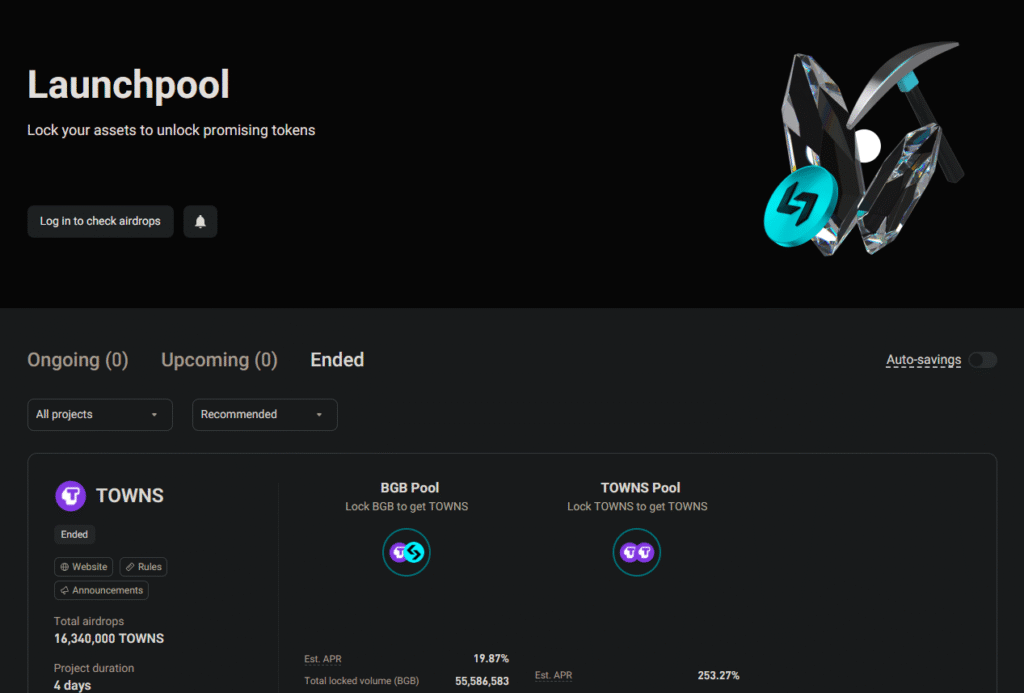

Launchpad and Launchpool: Chasing Xs

Platforms for investing in early-stage new projects.

| Exchange | Platform | Average ROI (2023) | Average ROI (ATH) | Notable Projects |

|---|---|---|---|---|

| Bitget | Launchpad | 2,535% | 1,238.3% | T2T2, TYPE, PandaFarm (BBO) |

| Binance | Launchpad | 2,901% | 18,481.4% | ARKM, EDU, ID, Axie Infinity |

| OKX | Jumpstart | 3,457% | 1,290.5% | SUI, ACE, BRWL |

At the Cutting Edge of Innovation: RWA and Onchain Integration

Bitget is embracing new trends.

Real-World Assets (RWA)

- Tokenized Stocks: Trading tokens of stocks like Tesla, Nvidia, and Apple.

- BGUSD: A “certificate for a stable asset” backed by tokenized RWAs.

Bitget Onchain

Trading trending onchain tokens directly from your spot account.

The Price of Victory: Costs and Execution Quality

Fee Analysis: How Much Are You Paying?

Trading Fees

- Spot Trading: 0.1% for both maker and taker. 20% discount when paying with BGB.

- Futures Trading: 0.02% for makers and 0.06% for takers.

Comparison of Futures Trading Fees

| Exchange | Maker Fee | Taker Fee | Token Discount |

|---|---|---|---|

| Bitget | 0.02% | 0.06% | Yes |

| Binance | 0.02% | 0.05% | Yes |

| Bybit | 0.02% | 0.055% | No |

Withdrawal Fees

| Asset | Network | Withdrawal Fee | Minimum Withdrawal |

|---|---|---|---|

| Bitcoin | Bitcoin | 0.00004 BTC | 0.0005 BTC |

| Tether | Ethereum (ERC20) | 3.00 USDT | 10 USDT |

| Tether | TRON (TRC20) | 1.50 USDT | 10 USDT |

| Tether | BNB Smart Chain | Free | 10 USDT |

Liquidity: Bitget’s Secret Weapon

Bitget is the most liquid platform for altcoins in the price range of 0.3%–0.5% of the market price.

API for Algo Traders: A Money-Making Machine

Bitget offers a powerful API that supports REST and WebSockets.

Final Verdict: Who Can You Trust with Your Money?

Consolidated Risk Assessment

- Regulatory Risk: Cryptocurrencies remain unstable.

- Market Risk: High volatility and leverage up to 125x.

- Platform Risk: There is always a chance of a breakdown.

- Copy Trading Risk: Past success does not guarantee future profits.

Trading Opportunities and Final Verdict

Generating “Alpha”:

- Launchpad: High IEO yields.

- Passive Income: Earn products with APYs up to 20%.

- Copy Trading (as an elite trader): Monetizing trading skills.

Execution Quality and Cost Efficiency:

- Altcoin Liquidity: Reduced slippage.

- Savings on Fees: Using BGB and choosing the right networks.

Automation and Social Trading:

- Copy Trading (as a subscriber): Access to the “talent market.”

- Trading Bots: A tool for systematic trading.

Final Verdict and Trader Profiles

Bitget is a powerful ecosystem that has found its niche.

- For the beginner/passive investor: A good starting platform.

- For the active altcoin trader: A competitive advantage.

- For the algorithmic trader: A reliable API.

- For the ecosystem investor: Attractive for long-term investments.

Disclaimer: This article is not financial advice. Do your own research. You are fully responsible for your investment decisions.